- Published on

[DXPE] Industrial Growth At A Discount

- Authors

- Name

- Perpetual Alpha

Summary

- This industrial distribution leader specializes in maintenance and repair essential for keeping factories and energy infrastructure operating efficiently.

- Operating across three business segments, this company delivered 15.5% sales growth in Q1, driven by both organic expansion and strategic acquisitions.

- This company notched strong sales across all segments in Q1, with its pumping solutions sales growing an astounding 39% Y/Y.

- Six consecutive earnings beats demonstrate operational excellence and margin improvements position the firm for sustained profitability growth.

- Despite nearly 100% TTM returns, this pick trades at a 54% discount based on its trailing twelve-month PEG ratio.

Business Overview

DXP Enterprises (DXPE) is a leading industrial distribution and service company serving North America and select international markets. The company specializes in providing maintenance, repair, operating, and production (MROP) supplies and services, with a core focus on rotating equipment, bearings and power transmission, industrial supplies, and safety products. This equipment is essential for keeping factories, energy plants, and infrastructure running safely and efficiently, making DXPE a vital partner in the revitalization of infrastructure in the industrial sector.

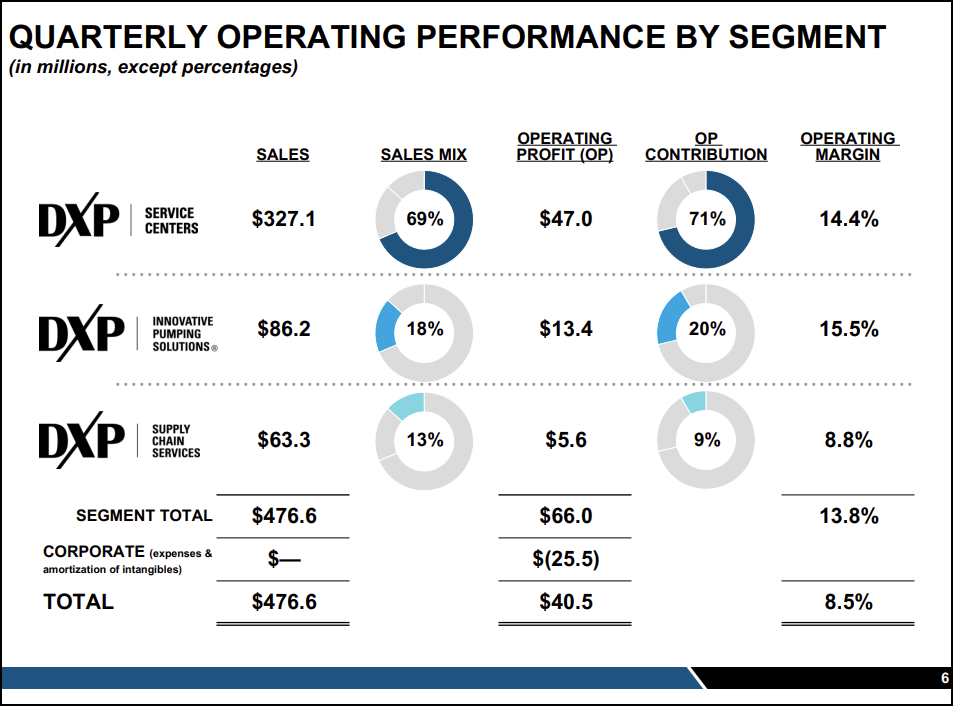

The company is structured around three major segments:

Service Centers offer a broad array of maintenance, repair, and technical services. This segment accounts for roughly 70% of the company’s sales.

Innovative Pumping Solutions (IPS), which delivers custom-engineered pump packages and remanufacturing, adds another 18% to the sales mix.

Supply Chain Services (SCS), which manages procurement, inventory, and logistics for its industrial clients, represented 13% of sales in Q1.

Source Link: DXPE Q1 2025 Investor Presentation

DXPE’s wide product and service mix serves a wide range of industries, including oil and gas, petrochemical, mining, construction, and general manufacturing.

The company’s growth strategy is anchored in both organic initiatives and strategic acquisitions. DXPE completed seven acquisitions in 2024 as part of an aggressive M&A strategy targeting complementary businesses that expand geographic reach and technical capabilities, particularly in water infrastructure. This approach has enabled DXP to penetrate higher-margin product offerings and enhance recurring revenue streams.

DXPE has benefited from its comprehensive portfolio, deep technical expertise, and scalable business model. The company has demonstrated the ability to adapt to changing market demands and, more recently, to deliver operational efficiencies that have contributed to robust financial performance, including record revenues that have exceeded estimates in four of the last five quarters.

Our Buy Thesis

DXPE is a critical partner serving broad-based industrial end markets. The company’s expansive business has provided resilience in the uncertain macro environment, delivering growth despite a slight contraction in manufacturing indicators in Q1. DXPE’s strategic focus on expansion in high-growth areas such as water infrastructure and safety services has aligned well with secular trends toward more sustainable industrial solutions.

The company’s recent financial results underscore its strong growth trajectory. DXPE’s IPS segment led growth in Q1, with a 39% increase fueled by powerful demand in both energy and water platforms. Service Centers also posted record sales, supported by a diverse product line and geographic expansion. Top-line growth has been complemented by profitability gains, with triple-digit basis point margin improvement reflecting operational leverage and contributions from higher-margin acquisitions.

Strong project demand is evidenced by the company’s energy-related backlog reaching an all-time high, while its water platform has reached ten consecutive quarters of sequential growth. The company has been able to capture market share through its

customer-first approach in its MRO services, combined with trends toward sustainable industrial solutions and infrastructure modernization.

With six consecutive quarters of earnings beats, DXPE has demonstrated that its high-growth trajectory is durable, positioning the company for potential further success in 2025.

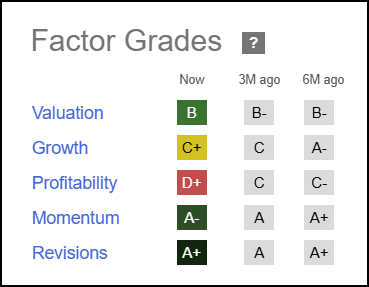

Seeking Alpha Factor Grades rates investment characteristics on a sector-relative basis. The company exhibits strong fundamentals, including an attractive valuation. DXP also displays strong timeliness indicators, including ‘A-’ momentum and earnings revisions.

DXPE Stock Factor Grades

DXPE Stock Growth and Profitability

DXPE has delivered robust growth and profitability in the most recent quarter. The company’s 15.5% Y/Y sales growth in Q1 was driven by 11% organic growth and $31.1M from its strategic acquisitions. DXPE also delivered sequentially, with sales increasing 1.2% Q/Q. As mentioned above, the IPS segment led in terms of both sales and profitability growth, while Service Centers achieved record sales, up 13.4%. In terms of forward-looking metrics, DXPE stands out both in its top- and bottom-line growth. FWD revenue growth stands at 6.84%, while FWD EBITDA growth is 10.16%, these are 48% and 50% above the sector median, respectively.

In terms of profitability, gross margins expanded 151 bps to 31.5%, and adjusted EBITDA margins reached 11% in Q1 2025. All segments saw improvement in their operating income margins, fueled in part by higher margin acquisitions. DXPE displays a TTM ROE of 19.43% and an asset turnover ratio of 1.5x; these are 55% and 83% above the sector median, respectively.

The company’s strong balance sheet and continued investment in growth initiatives have helped sustain its market outperformance.

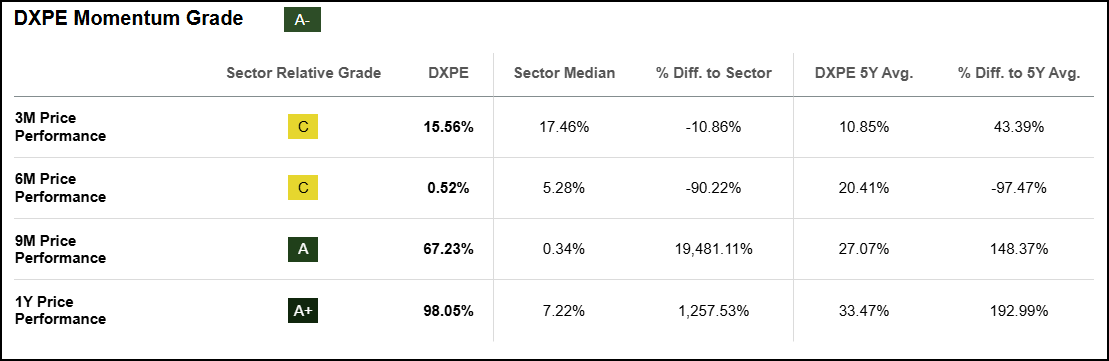

DXPE Momentum Grade

DXPE has an ‘A-’ Momentum grade and has returned nearly 100% on a trailing one-year basis.

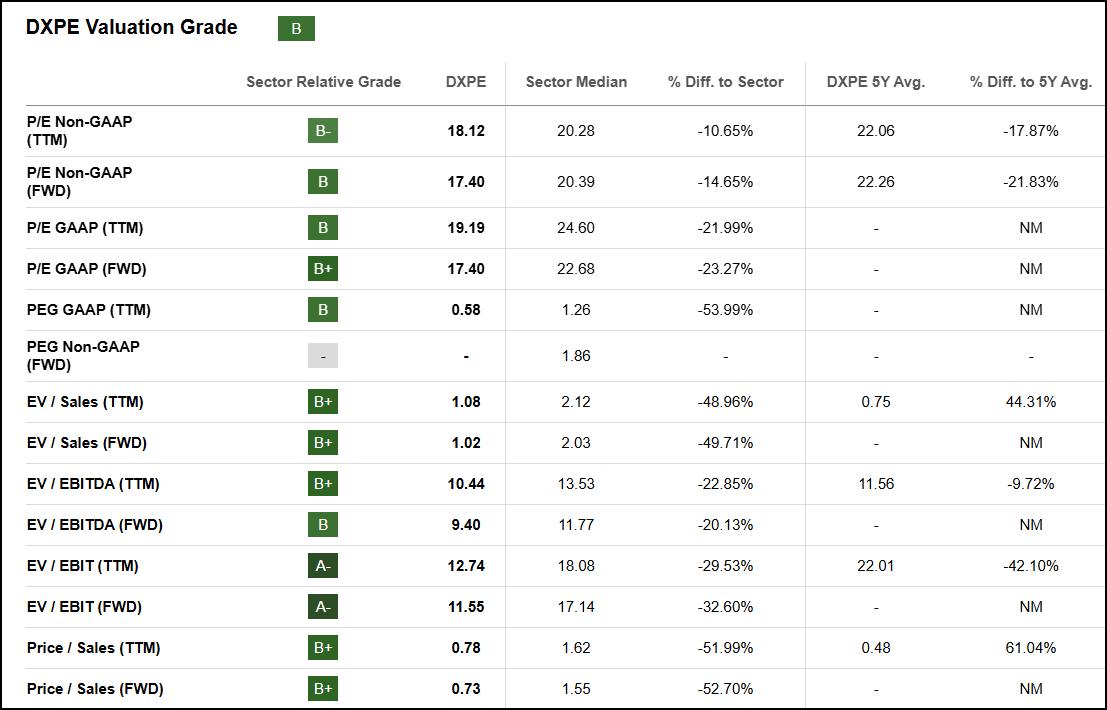

DXPE Stock Valuation

Despite the exceptional gains, DXPE has maintained an attractive valuation, trading at a discount across the majority of its valuation metrics.

DXPE Valuation Grade

Notably, the company trades at a 54% reduction in terms of its TTM PEG ratio, indicating the company is undervalued relative to its growth prospects.

Potential Risks

If macroeconomic uncertainty evolves into an economic downturn, DXPE could face reduced industrial demand. The company’s acquisition-driven growth strategy could pressure short-term profitability and increase integration risks. Tariff changes and trade policy uncertainties are causes for concern, and the company’s strategy of passing tariffs through to the end customer could have ramifications for future demand. Trade policy shifts could also disrupt supply chains and force difficult pricing decisions, though the company is somewhat protected by the flexible structure of its pricing agreements.

Concluding Summary

DXP Enterprises (DXPE) is a leading industrial distribution and service company specializing in maintenance, repair, operating, and production (MROP) supplies. The company operates through three major segments: Service Centers offering maintenance and technical services; Innovative Pumping Solutions (IPS) providing custom-engineered pump packages; and Supply Chain Services (SCS) managing procurement and logistics for industrial clients. DXPE has demonstrated strong financial performance, with 15.5% year-over-year sales growth driven by 11% organic growth and strategic acquisitions, while the IPS segment led with 39% growth and Service Centers achieved record sales. The company maintains attractive valuation metrics despite nearly 100% returns over the trailing one-month period, trading at a 57% discount on its TTM PEG ratio. DXPE's comprehensive portfolio, technical expertise, and strategic focus on high-growth areas like water infrastructure and safety services position it well for continued success, with six consecutive quarters of earnings beats and a powerful momentum trend.

For Alpha Picks investors with a fixed amount of capital who are looking for a more active approach, consider the PRO Quant Portfolio (PQP). PQP delivers a disciplined, data-driven, systematic model portfolio. Like Alpha Picks, PQP is powered by Seeking Alpha's proprietary Quant system. The portfolio draws from nearly 5,000 U.S.-listed stocks and ADRs worldwide, selecting top opportunities based on rigorous multi-factor selection. PQP holds 30 equal-weighted positions, rebalanced weekly to reflect updated ratings and market conditions. Subscribers receive weekly alerts on all trades and detailed analysis from the Quant Team, making it easy to follow or use as an idea generator.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.