- Published on

[WLDN] AI Infrastructure Power Play

- Authors

- Name

- Perpetual Alpha

Summary

- With 35-50% projected growth in US power demand by 2040, this company stands to benefit from seismic shifts in electrification trends.

- Strategic acquisitions are expanding the firm's commercial client base and electrical engineering capabilities in a high-growth sector.

- The company delivered record Q1 2025 results with 24% revenue growth and has beaten earnings expectations for nine consecutive quarters.

- Despite 117% stock gains, this pick trades at a 62% discount to the sector in terms of its TTM PEG.

Business Overview

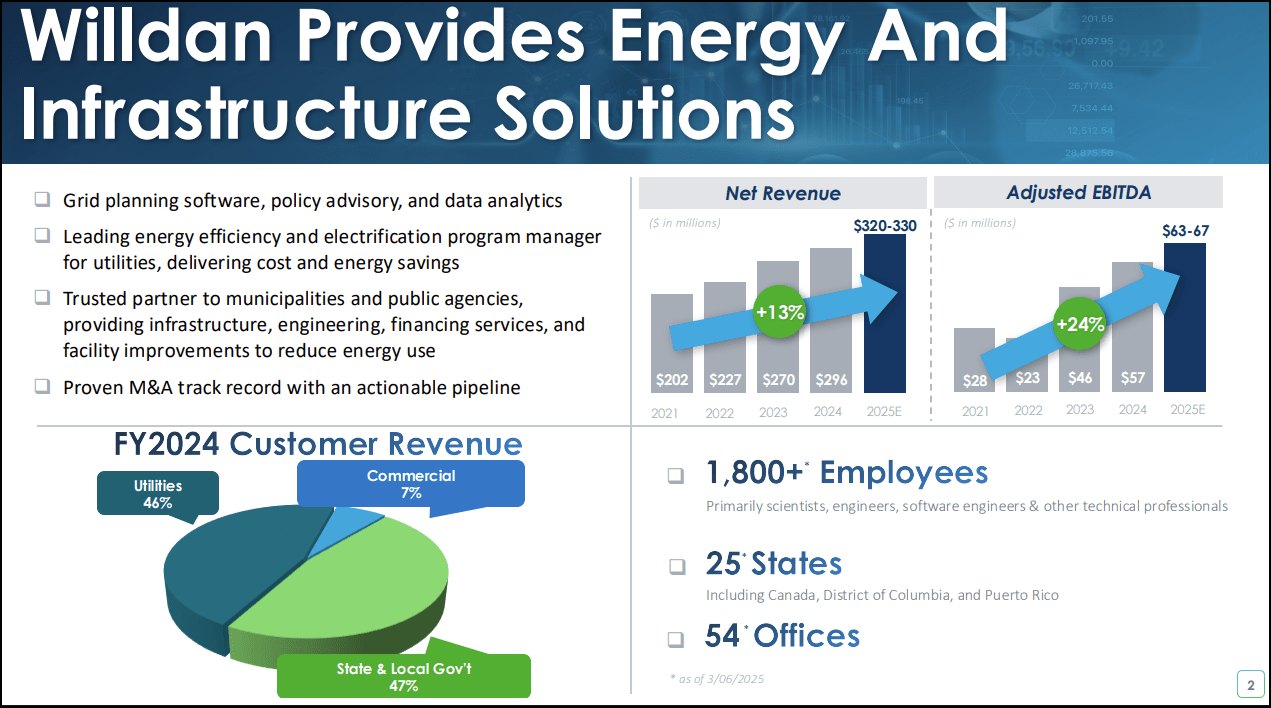

Founded in 1964 in Southern California, Willdan Group Inc. (WLDN) has grown from a regional engineering firm to a prominent provider of comprehensive solutions for energy, engineering, and sustainability challenges. The company works alongside public agencies, utilities, and private sector clients to help design and implement innovative energy and infrastructure solutions.

With over 1,800 employees, Willdan serves a diverse client set that spans public agencies, utilities, and private sector organizations. The company's expertise encompasses the full project lifecycle, from initial planning and design through implementation and project management. In FY 2024, WLDN's revenue mix was 47% from state and local governments, 46% from utilities, and 7% from commercial clients.

Strategic acquisitions have been central to WLDN's growth strategy. The company's March 2025 acquisition of Alternative Power Generation (APG) strengthened its electrical engineering capabilities while providing a Rolodex of commercial clients, further diversifying the company’s customer mix.

Willdan is addressing a rapidly growing need in the market: data centers and commercial electric loads are driving unprecedented demand for sophisticated electrical infrastructure. By blending construction management expertise with grid analytics software and energy policy specialists, the company is at the forefront of building comprehensive solutions for an increasingly complex electrical grid.

Our Buy Thesis

Willdan is riding a powerful wave of demand as AI and data center growth reshape the U.S. energy landscape. This surge in electricity needs is expected to push U.S. power demand up by 35-50% by 2040. The company's energy solutions are in higher demand than ever, with CEO Mike Bieber noting:

Our commercial work is increasingly centered around electricity usage at data centers, where AI-driven load growth is creating significant demand. Willdan is helping technology clients navigate energy constraints, optimize infrastructure, and meet aggressive power requirements.

Willdan’s recent quarter set records for both revenue and profits, with a track record of nine consecutive earnings beats and a robust pipeline of new contracts, particularly in the public and utilities space. The company is also diversifying its customer base and expanding its engineering capabilities through acquisitions, thereby deepening its reach in the fast-growing data center segment.

As AI continues to drive structural shifts in energy consumption, Willdan, like fellow Alpha Pick, Argan, Inc. (AGX), is well-positioned for sustained demand for its expertise in energy infrastructure solutions. Notably, the company has limited exposure to federal contracts, making it relatively insulated from shifting policy priorities at the federal level.

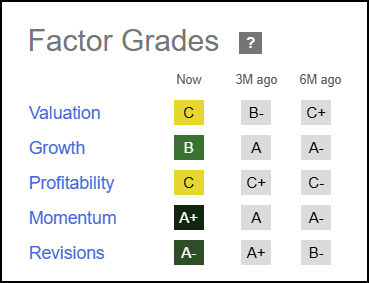

Seeking Alpha Factor Grades rates investment characteristics on a sector-relative basis. The company exhibits strong fundamentals, including impressive growth. Willdan also displays strong timeliness indicators, including ‘A+’ momentum and ‘A-’ earnings revisions.

WLDN Stock Factor Grades

WLDN Stock Growth and Profitability

WLDN delivered a record-breaking first quarter in 2025, with revenue climbing 24% Y/Y to $152M, while adjusted EPS rose 58% to $0.63. Growth was broad-based, spanning both the Energy and Engineering & Consulting segments, with notable momentum from new contracts and strategic acquisitions. This impressive showing prompted the company to raise its guidance, expecting revenues to be in the range of $325M to $335M for FY 2025.

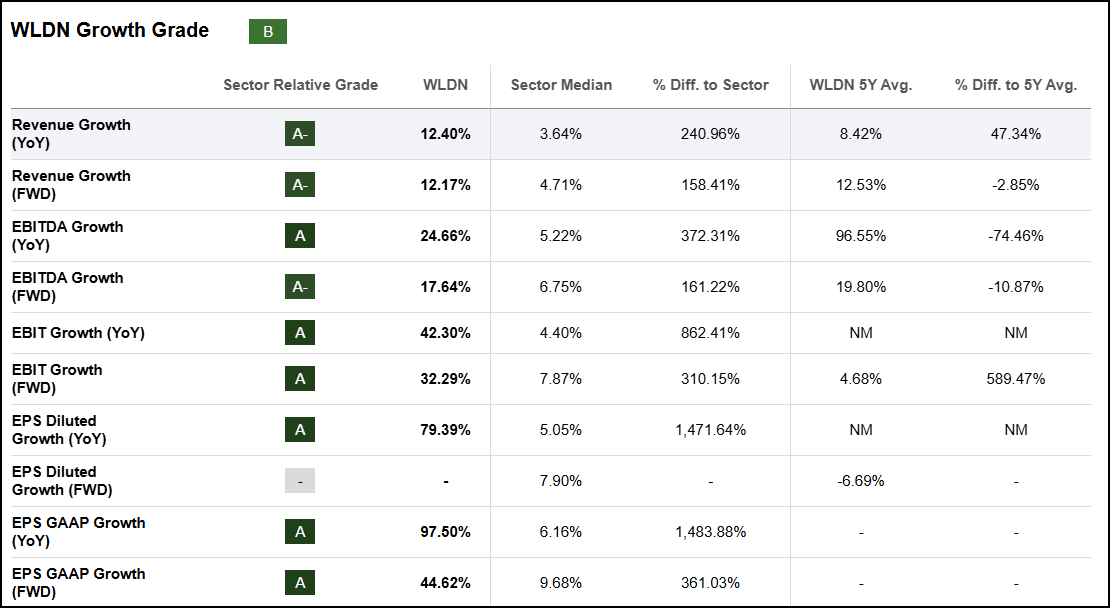

WLDN's Y/Y growth characteristics are complemented by solid forward-looking projections; the company sports a FWD EPS GAAP growth and a FWD revenue growth that are 361% and 158% above the sector median, respectively.

WLDN Growth Grade

In Q1, operating leverage improved as G&A expenses grew more slowly than revenue, and margin gains pushed the company closer to its 20% EBITDA target. CEO Mike Bieber commented:

“Well, Q1 came in above our own internal forecast. It was just very strong. And it wasn't any one area; it was across the board. We're just performing very well. And some of our customers are looking at upsizing the size of the contract that we have on these legacy programs.”

The company’s exceptional financial performance has contributed to the stock’s accelerating momentum. WLDN has returned nearly 117% on a trailing one-year basis and more than 50% in just three months.

WLDN Stock Valuation

Despite the exceptional gains, WLDN has maintained a solid valuation that is in line with the broader industrials sector. The company sports a TTM PEG of 0.5x, which is more than 60% discounted relative to the sector, while its FWD EV/Sales stands at 1.5x vs. the sector’s 2x.

Potential Risks

Willdan faces several risks, including tariff-related price increases on specialized equipment. An increase in input costs could squeeze margins or delay projects. The company also has a high concentration of contracts in California's public sector, making it vulnerable to state budget cuts or shifting policy priorities. The company's reliance on acquisitions brings additional challenges related to integration if those companies underperform. WLDN also faces exposure to regulatory changes, litigation, and compliance costs. Physical risks, such as severe weather events, also have the potential to affect the delivery of its engineering projects.

Concluding Summary

Willdan Group Inc. (WLDN) has transformed from a regional California engineering firm into a comprehensive energy and infrastructure solutions provider, capitalizing on surging demand driven by AI and data center growth. Willdan delivered record Q1 2025 results, with 24% revenue growth and 58% adjusted EPS growth, prompting raised guidance and continuing a streak of nine consecutive earnings beats. Strategic acquisitions like Alternative Power Generation (APG) have strengthened capabilities while diversifying the customer base beyond its traditional government focus. Despite stock gains of nearly 117% over the last year, the company maintains attractive valuations, with a TTM PEG significantly below sector averages.

For Alpha Picks investors with a fixed amount of capital who are looking for a more active approach, consider the PRO Quant Portfolio (PQP). PQP delivers a disciplined, data-driven, systematic model portfolio. Like Alpha Picks, PQP is powered by Seeking Alpha's proprietary Quant system. The portfolio draws from nearly 5,000 U.S.-listed stocks and ADRs worldwide, selecting top opportunities based on rigorous multi-factor selection. PQP holds 30 equal-weighted positions, rebalanced weekly to reflect updated ratings and market conditions. Subscribers receive weekly alerts on all trades and detailed analysis from the Quant Team, making it easy to follow or use as an idea generator.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha