- Published on

[SSRM] Pike's Peak Gold Rush 2.0

- Authors

- Name

- Perpetual Alpha

Summary

- Operating five mines across North America, Argentina, and Turkey, the company's recent acquisitions have earned it the title of third-largest gold producer in the U.S.

- This company has shown strong momentum, with Q1 2025 revenue surging 37.5% Y/Y and operating cash flow of $85M, while maintaining ample liquidity.

- Despite gaining more than 70% over the past six months, this company maintains an exceptional valuation, with a FWD PEG that is more than 90% discounted to the sector.

- Favorable market dynamics coupled with operational excellence have contributed to earnings that are projected to grow 313% Y/Y by the end of FY 2025.

Business Overview

Formerly known as Silver Standard Resources, SSR Mining Inc. (SSRM) specializes in the exploration, production, development, and operation of precious metals projects globally. The company is primarily engaged in mining and processing gold and silver, with additional production of copper, lead, and zinc concentrates.

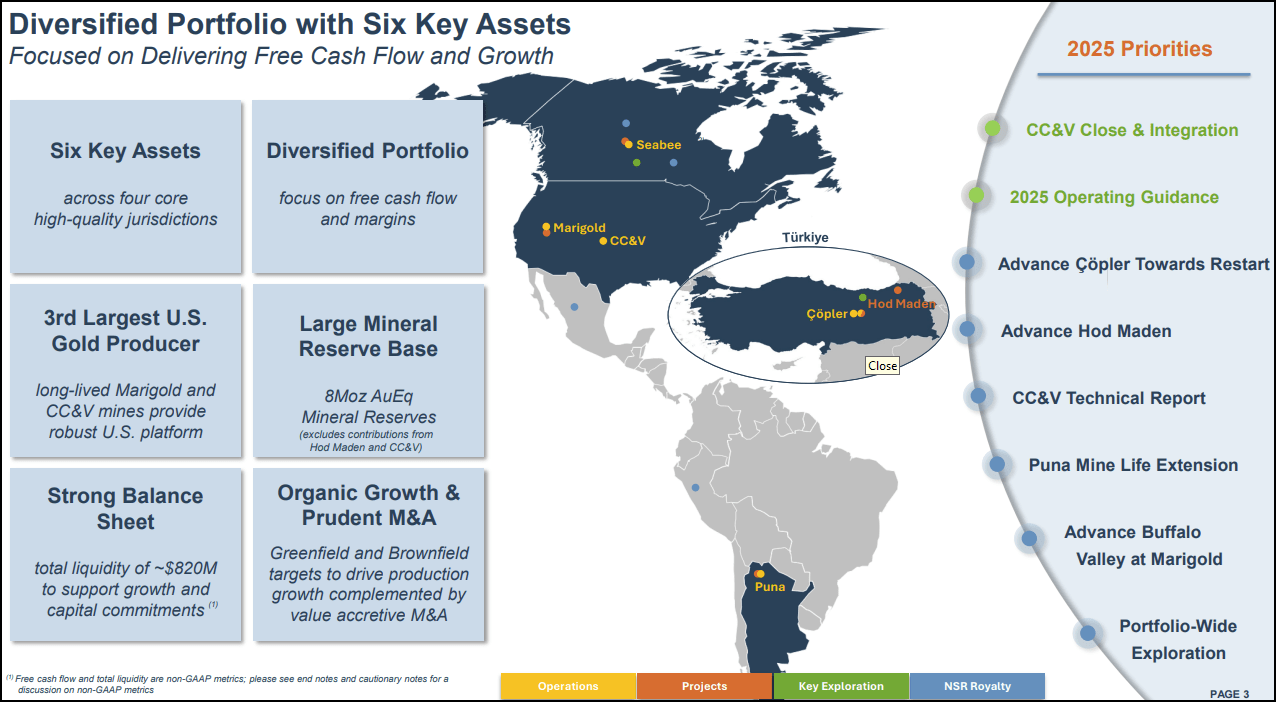

Source Link: SSRM Q1 2025 Investor Presentation

SSRM operates five principal mines strategically located in major precious metal districts: the Çöpler mine in Erzincan, Turkey, the Marigold mine in Nevada, USA, the Cripple Creek & Victor mine in Colorado, USA, the Seabee mine in Saskatchewan, Canada, and the Puna mine in Jujuy, Argentina. These mines are at the center of the company's operations, producing gold doré and base metal concentrates. Gold doré, an intermediate product in the gold mining process, accounted for roughly 67% of the company's revenue in 2024.

Fun side note, the Colorado gold rush was better known as the Pike's Peak gold rush, named after the iconic mountain in the area. It kicked off in 1858 and drew in about 100,000 hopeful prospectors to Pike's Peak. Those treasure hunters were nicknamed "Fifty-Niners" because 1859 was when things really took off. Today, SSR Mining owns the Cripple Creek & Victor mine, which sits on the southwest side of Pike's Peak.

Additionally, the company maintains a robust pipeline of development and exploration projects in these jurisdictions and beyond—including Peru, the USA, Mexico, and Canada—ensuring long-term growth potential.

SSR Mining possesses a diversified, high-quality asset portfolio that helps mitigate geopolitical risks endemic to multinational companies. SSR Mining's growth strategy centers on expanding production through both organic initiatives, such as optimizing existing mines and advancing development projects like Hod Maden and strategic acquisitions like the CC&V mine. The company invests heavily in exploration and mine life extensions to sustain and grow its asset base, while maintaining a strong financial position with ample liquidity.

Our Buy Thesis

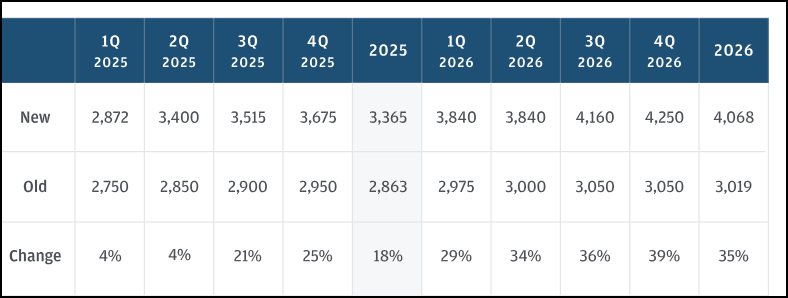

SSR Mining Inc. (SSRM) is well-positioned to benefit from favorable market dynamics, the precious metals sector is experiencing significant momentum, with gold prices surging past $3,000 per ounce. Institutional forecasts suggest continued appreciation. J.P. Morgan anticipates prices reaching $3,675 by late 2025 and $4,000 by mid-2026. These positive trends stem from persistent geopolitical tensions, inflationary pressures, and central bank monetary easing policies that reinforce precious metals' appeal as defensive assets.

Gold Price Forecasted to Climb

From an operational perspective, SSRM is executing well on its growth strategy while maintaining financial discipline. The strategic acquisition of the Cripple Creek & Victor operation has significantly enhanced the company's asset profile, increasing mineral reserves by 85% and establishing SSRM as the third-largest gold producer in the United States. The CC&V integration, combined with development projects like Hod Maden, creates a clear pathway for production growth and margin enhancement, particularly in the current high-price environment.

SSRM is well-diversified, with lower-risk mining jurisdictions across North America and Argentina. This strategic positioning reduces exposure to regulatory and political uncertainties that can impact mining operations. The company's emphasis on operational efficiency, cost discipline, and environmental stewardship further distinguishes it within the sector.

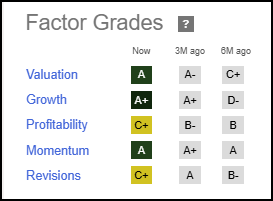

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. The company exhibits strong fundamentals—including exceptional growth, a heavily discounted valuation, and solid profitability.

SSRM Stock Factor Grades

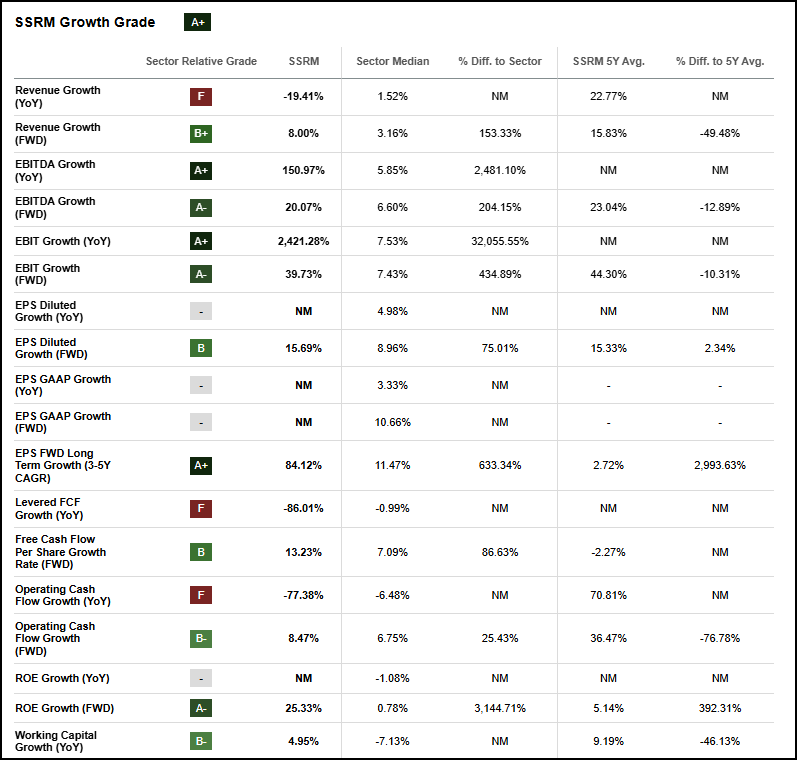

SSRM Stock Growth and Profitability

SSRM exhibits exceptional growth and strong operational momentum. Q1 2025 saw a remarkable surge in earnings, with an EPS of $0.29 compared with -$0.09 in Q4 2024 . Cash generation was particularly robust, with operating cash flow reaching $85 million and free cash flow of $39 million, demonstrating the company's ability to convert earnings into tangible returns. When looking at the company's growth trajectory longer term, estimates are promising. The company has an 84% FWD EPS long-term growth rate (3-5Y CAGR), which is more than 600% above the sector median, and a forward ROE of 25%.

SSRM Growth Grade

The company maintains solid financial flexibility, with total liquidity exceeding $800 million, positioning it to fund multiple growth initiatives. Profitability highlights for the company include a TTM EBITDA margin of 50%, which is 185% above the sector median.

SSRM reaffirmed optimistic 2025 guidance projecting 410,000 to 480,000 gold equivalent ounces (a 10% increase over 2024), while maintaining exceptional financial flexibility with over $800 million in total liquidity to fund growth initiatives, including $60-100 million in Hod Maden development capital.

SSRM Stock Valuation

SSRM boasts an exceptional valuation, which has improved from a 'C+' to an 'A' over the last six months, despite returning over 70% in the same period. The company's FWD PEG is 91% discounted relative to the materials sector, while its FWD Price/Book comes in at 0.8x vs. the sector's 1.5x.

Potential Risks

SSR Mining faces multiple key investment risks, including geopolitical exposure, commodity price volatility, and cost inflation, as mining production costs have risen over the past several years.

Additional risks include regulatory and environmental compliance challenges, supply chain disruptions from geopolitical tensions. The capital-intensive nature of mining projects requires substantial upfront investment with long payback periods that create financial risks.

Recent operational incidents, including the temporary suspension of the Seabee mine due to forest fires, have led to production halts that could impact profitability. The hazardous nature of the industry, including a recent deadly landslide at its Çöpler mine, has led to legal actions, reputational damage, and increased scrutiny from regulators.

Concluding Summary

SSR Mining Inc. (SSRM) is a global precious metals mining company operating six principal mines across North America, Argentina, and Turkey, primarily producing gold and silver, along with copper, lead, and zinc concentrates. The company has demonstrated powerful momentum, driven by strong operational performance, including a 37.5% surge in Q1 2025 revenue and robust cash generation of $85 million in operating cash flow. The transformative Cripple Creek & Victor acquisition has expanded the company's reserves by 85% and established SSRM as the third-largest U.S. gold producer. The company trades at an attractive valuation with exceptional growth prospects, featuring an 84% forward long-term EPS growth rate and benefiting from favorable gold market dynamics, with institutional forecasts targeting $3,675-$4,000 per ounce by 2025-2026. This promising trajectory is reflected in the company's strong fundamentals and bullish price momentum over the past year.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.