- Published on

[LRN] Scaling New Heights In EdTech

- Authors

- Name

- Perpetual Alpha

Summary

This company has benefited from structural changes following the pandemic, with the online education market expected to grow at a 23% CAGR through 2032.

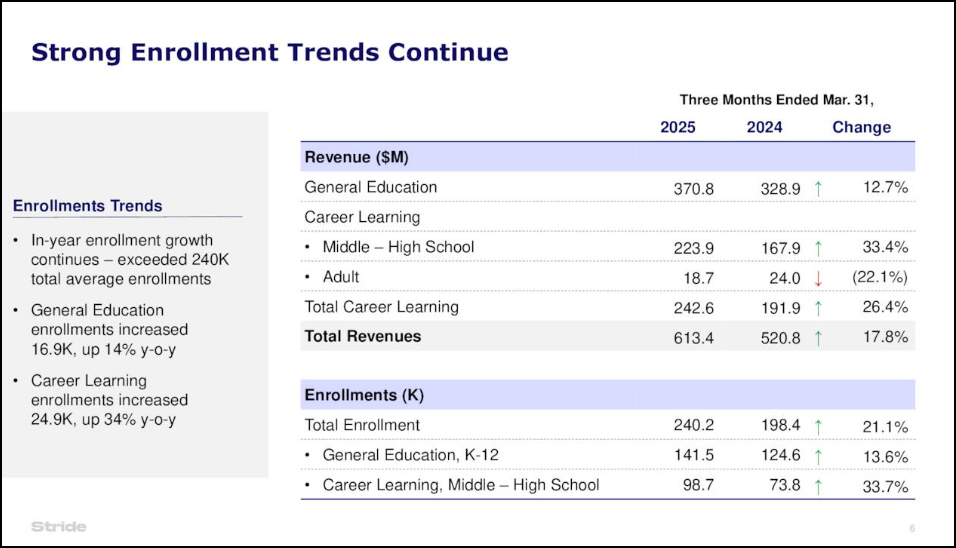

Record enrollments surged 21% year-over-year in Q3 FY2025, while career learning revenues soared 33% due to expansion into high-growth sectors like IT and healthcare.

Gross margins improved by 190 basis points, reflecting operational discipline and the company’s highly scalable tech platform.

Strategic investments in AI, curriculum, and key partnerships are driving growth and contributing to the stock’s ‘A+’ momentum over the last year.

Business Overview

Stride, Inc. (LRN), formerly known as K12 Inc., has provided online education services since 2000. Initially focused on serving as an alternative to brick-and-mortar K-12 schools, the company rebranded in 2020 to reflect an expanded scope of providing lifelong learning and professional education across age groups.

LRN's core services include delivering proprietary and third-party online education curriculum and educational services to K-12 students, schools, and districts, as well as career learning and adult upskilling programs. For adult learners, Stride provides career-focused training in fields like healthcare and technology under key subsidiaries such as Galvanize, Tech Elevator, and MedCerts.

During COVID-19, Stride experienced a significant acceleration in its business due to the sudden and widespread shift to remote learning. This resulted in a surge of enrollments in Stride's virtual and blended learning programs. The company's established infrastructure and expertise in online K-12 education allowed it to scale quickly to meet demand. COVID-19 has also served as a boon for the company in terms of heightened awareness and acceptance of online education, leading to sustained growth even after schools reopened.

Stride has formed a constellation of key partnerships to enhance student outcomes and career readiness. For example, through Tallo, Stride students can explore career pathways, apply for internships, and match with scholarship opportunities. These partnerships serve as a bridge, connecting Stride students to real-world opportunities and career success.

Our Buy Thesis

Stride stands out as a top education services stock thanks to a combination of powerful market trends and strong execution. The shift toward flexible, personalized, and career-focused education, with both young students and adult learners, has greatly accelerated since the COVID-19 pandemic. The global online education market was valued at $49B in 2023 and is expected to reach $345B by 2032, growing at a CAGR of 23.1%.

Stride has capitalized on these trends, reporting record enrollments up 21% Y/Y in Q3 FY 2025. In particular, LRN has aggressively expanded its career learning programs in recent quarters to high-growth sectors like IT and healthcare. This growth strategy has been successful, with career learning revenue soaring 33% in Q1. This diversification is important, as it positions Stride to capture both the youth and adult segments in the booming e-learning market.

The company’s operational discipline is delivering tangible payoffs, with triple-digit basis point improvement in gross margins. Recent investments in technology, curriculum, and strategic acquisitions are driving both growth and profitability. Stride’s proprietary technology platform enables rapid scaling of enrollments while keeping costs low and leverages AI to personalize learning paths, resulting in high levels of customer satisfaction.

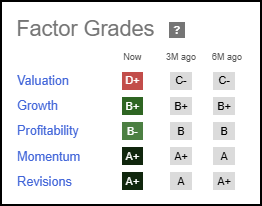

Seeking Alpha Factor Grades rates investment characteristics on a sector-relative basis. The company exhibits strong fundamentals, including exceptional growth and solid profitability. LRN also exhibits powerful momentum and excellent analyst revisions.

LRN Stock Factor Grades

LRN Stock Growth and Profitability

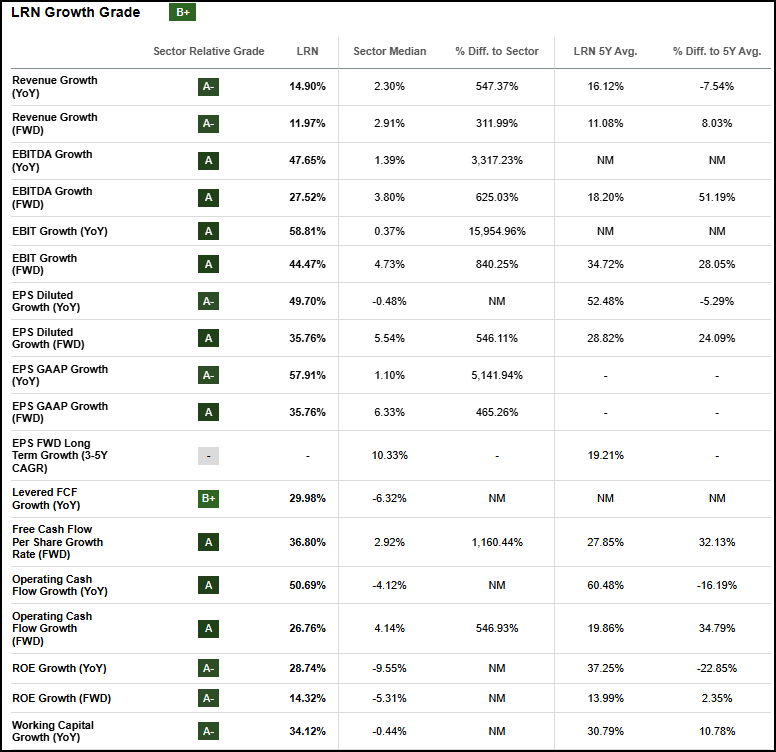

LRN has a demonstrated track record of strong growth and improving profitability. The company reported an 18% Y/Y revenue increase, driven by robust enrollment growth, up 21% across all segments and 34% in its high-margin Career Learning segment. The company’s overall ‘B+’ Growth grade is supported by impressive forward-looking metrics, including 36% FWD Diluted EPS growth and 27% operating cash flow growth, which are 546% and 547% above the sector median, respectively.

LRN Growth Grade

Management raised full-year guidance, with revenue and operating income expected to exceed long-term targets. Gross margins improved by 190 basis points, and adjusted operating income climbed 47%, aided by Stride’s SaaS program scalability. The profitability gains have contributed to the company’s standout ROE of 24%, which, along with ‘A+’ momentum, has earned the company recognition on Morgan Stanley’s list of attractive small-cap stocks.

Analysts are unanimous about the company’s positive prospects; LRN’s ‘A+’ EPS Revisions grade is supported by four FY1 upward revisions vs. zero downward revisions.

LRN Stock Valuation

Stride’s valuation is somewhat stretched due to the stock’s incredible run-up, while LRN has returned 117% over the last year. However, key metrics suggest the stock has further room to run, including a TTM PEG of 0.48x vs. the sector’s 0.72x.

Potential Risks

Key risks for LRN include shifting policy and regulatory environments, as changes in state or federal funding or virtual school regulations could impact revenue streams and contract renewals. Though Stride’s current revenue structure makes it relatively insulated from shifts in federal policy.

I know there's lots of discussion about federal funding and the impact that could have on Stride. I want to reiterate what we said last quarter: well, less than 5% of our overall revenues come from federal resources,” said Donna Blackman, CFO of Stride.

Legal missteps, reputational challenges, and quality control issues could result in contract terminations, as was the case with the Gallup-McKinley County Schools, which highlighted issues in academic performance and compliance. Stride must also navigate increasing competition and evolving curriculum standards. While these risks are significant, Stride’s diversified revenue base and limited reliance on federal funds help mitigate severe impacts from policy shifts.

Concluding Summary

Stride, Inc. has experienced significant growth due to increased demand for online education that has accelerated in the aftermath of COVID-19. The company’s diversified approach, serving both youth and adult learners, combined with its scalable technology platform and strategic partnerships, positions it well in the booming e-learning market, which is expected to grow to a $345B market by 2032. Stride has demonstrated exceptional growth and profitability, including 21% Y/Y enrollment growth and substantial margin improvement. The stock’s excellent fundamentals, coupled with positive timeliness indicators, suggest the company has the potential to further build on its success.

Written by Steven Cress

Head of Quantitative Strategies at Seeking Alpha