- Published on

[UNFI] Stock Up: This Consumer Staple Is Outperforming

- Authors

- Name

- Perpetual Alpha

Summary

- This leading food distributor is positioned to capture growth in the organic food market, which is projected to expand at an 11.2% CAGR through 2033.

- Despite returning over 165% in the past year, this company trades at an exceptional discount, featuring a Price/Book ratio 66% below the sector.

- Operational improvements have reduced inventory loss to pre-COVID levels, with near-term profitability projected to explode.

- Management’s proactive approach to debt management has reduced net leverage to its lowest levels since 2023 while raising FY 2025 guidance.

- Since its inception, the Alpha Picks Portfolio Total Return has delivered an impressive +161.80% versus the S&P 500’s +55.65%, with seven out of 35 Alpha Picks returning more than 100%.

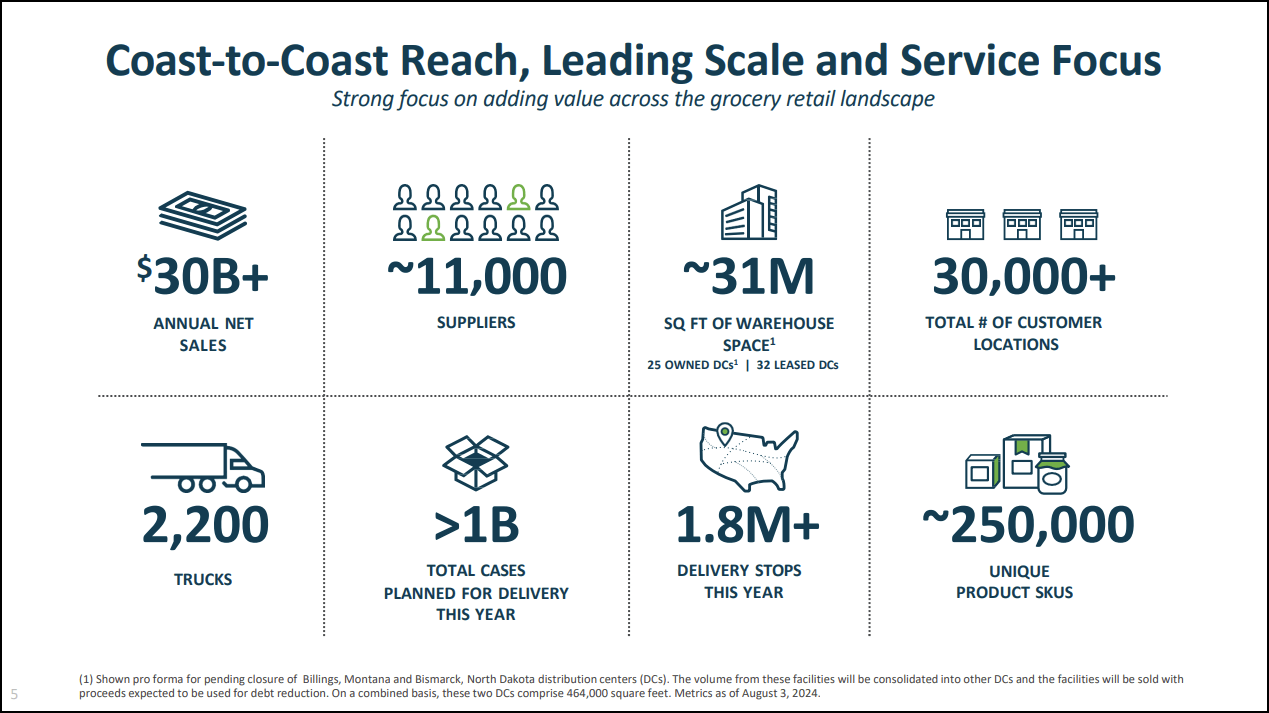

Business Overview

United Natural Foods, Inc. (UNFI) is a prominent North American wholesale distributor of food products across natural, organic, specialty, and conventional groceries. Founded in 1976, this Rhode Island-based company has evolved into a crucial supply chain partner for food retailers, including Whole Foods Market, an affiliate of Amazon.com, Inc. (AMZN).

The company’s operations connect over 11,000 suppliers with over 30,000 customer locations throughout the U.S. and Canada. UNFI manages distribution through an extensive network of facilities that encompass over 31 million square feet of warehouse space.

UNFI continues to capitalize on rising consumer demand for organic and natural goods, leveraging its scale, innovation, and sustainability commitments to maintain its leadership in the health and wellness food sector.

“There's a whole lot of category momentum for natural, organic and specialty regardless of the channel. We're seeing that both across branded and then also across our own brand portfolio….we're seeing a very broad-based consumer trend towards better-for-you products and that would show up in our natural portfolio,” said UNFI CEO Sandy Douglas.

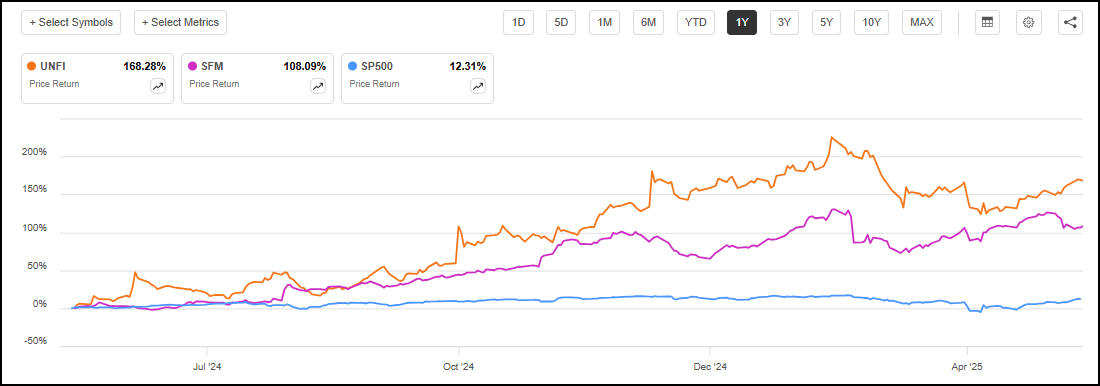

UNFI is also a key distribution partner for another top-performing Alpha Pick, Sprouts Farmers Market, Inc. (SFM), which has returned an incredible 103% since its addition to the AP portfolio in June 2024.

UNFI vs. SFM vs. S&P 500 Trailing One-Year Return

When examining both companies on a trailing one-year basis, we can see how closely aligned their growth trajectories have been, an outcome of the secular tailwinds benefiting the industry.

Our Buy Thesis

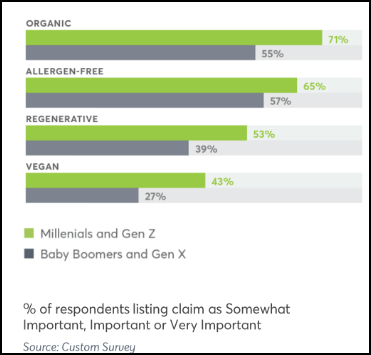

UNFI has benefited from a rapidly expanding organic and natural food sector, powered by multiple trends, including health-conscious millennials and Gen Z consumers and sustainability priorities. This global organic food market is projected to grow from $229B in 2024 to $594B in 2033, representing an 11.2% CAGR, significantly outpacing conventional food sales growth.

Younger Generations Strongly Prefer Organic to Conventional Groceries

UNFI has strategically positioned itself to capture growth, dividing operations into dedicated natural and conventional divisions in a company realignment. This reorganization is yielding results, with the natural segment achieving double-digit growth Y/Y and expanding its presence across diverse retail channels.

United has recently undergone a series of operational improvements, which are incrementally improving its profitability. By implementing lean management practices throughout its distribution centers, the company has successfully reduced inventory loss to pre-COVID levels while boosting productivity by 5-10%. Additionally, the company has optimized its network by closing underperforming locations, streamlining costs, improving cash flow, and supporting deleveraging efforts.

UNFI management is optimistic, delivering upwardly revised guidance for FY2025. This growth could be accelerated by inflation trending downward, further attracting customers to the segment that has shown resilience in the uncertain macro environment.

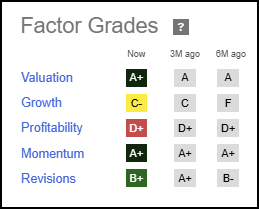

Seeking Alpha Factor Grades rates investment characteristics on a sector-relative basis. As of May 14, 2025, United Natural Foods, Inc. is the #1 Quant-ranked Food Distributor stock and #8 Quant-ranked Consumer Staples stock. The company exhibits strong valuation and momentum characteristics, as well as EPS Revision.

UNFI Stock Factor Grades

UNFI Stock Growth and Profitability.

UNFI delivered robust Q2 FY 2025 earnings, driven by operational gains, its strategic realignment, and a strong performance in its natural products division. The company achieved a 13% increase Y/Y in adjusted EBITDA. Sales grew nearly 5% to $8.2B, with natural products achieving 8% growth. While retail sales declined 3% due to store closures, same-store sales improved sequentially. UNFI raised its full-year guidance to an adjusted EBITDA of $550M to $580M, representing an 11% increase at the midpoint compared with 2024.

While the stock’s current profitability grade has room for improvement, the company has demonstrated a consistent track record, beating earnings estimates for the last seven consecutive quarters.

UNFI FY EPS Estimates

UNFI’s earnings estimates project explosive EPS growth, with near-term profitability expected to improve significantly. Capturing a stock before a period of significant earnings growth can be advantageous, as stock prices react positively to strong earnings, rewarding investors who take a position before it is widely recognized.

UNFI Stock Valuation

UNFI’s ‘A+’ Valuation Grade indicates the stock is trading at an exceptional discount relative to the sector. This is a remarkable feat considering the stock has returned more than 165% on a trailing one-year basis. UNFI’s solid valuation is backed by deeply discounted metrics, including a Price/Book FWD that is 66% below the sector median, as well as TTM Price/Sales of 0.05x vs. the Consumer Staples 1.17x.

Potential Risks

UNFI contends with intense competition from other distributors, and key anchor clients have the power to negotiate lower prices, potentially compressing margins. Changes in food safety, labor, and environmental laws could increase costs and compliance burdens for the company. Macroeconomic uncertainties such as inflation, commodity prices, and a severe economic downturn could impact consumer spending and subsequently profitability. UNFI carries a heavy debt burden due to its strategy of financing growth and operations through borrowing, putting the company at financial risk. However, management is actively working to manage its debt load.

“The strategic actions we took during fiscal 2024 and thus far in fiscal 2025 to strengthen our foundation and execute our multi-year plan are delivering results. During the first half, adjusted EBITDA grew nearly 14%. Free cash flow generation climbed nearly $250 million, and net leverage has been reduced to 3.7 turns. This is the lowest net leverage level since fiscal 2023,” said Sandy Douglas, CEO of UNFI.

This statement highlights UNFI’s commitment to debt management through asset sales and improved free cash flow.

Concluding Summary

UNFI is the # 8 Quant-ranked Consumer Staples stock, a sector that tends to provide stability in periods of macroeconomic uncertainty like the current moment. The company is strategically positioned to capitalize on the rapidly expanding organic food market, which has a projected CAGR of 11.2% through 2033. Broad operational improvements have helped drive seven consecutive earnings beats. With management raising FY 2025 guidance, UNFI offers defensive positioning and growth potential in today’s uncertain macroeconomic environment. Despite returning over 165% in the past year, UNFI is trading at a deep discount to the consumer staples sector, while still offering powerful momentum and an excellent EPS revisions grade.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.