- Published on

[MFC] Encore Selection: Banking On Proven Performance

- Authors

- Name

- Perpetual Alpha

Summary

- Originally added to Alpha Picks in November 2023, this financial services giant has delivered an impressive 74% return, with over 30% gains in the past year.

- The company achieved record core earnings over $7B in 2024, and core EPS rose 11% Y/Y.

- Trading at a steep discount, this company combines value with growth potential, boasting FWD revenue growth of 15%.

- This company underscores its strong commitment to shareholder value, returning $6B to shareholders in 2024, while offering a solid FWD yield of 4.16%.

- Digital transformation investments of $600M generated substantial benefits in 2024, driving a 44.8% efficiency ratio and enhancing the customer experience.

Business Overview

Manulife Financial Corporation (MFC) is a leading international financial services group headquartered in Toronto, Canada. Originally selected on November 1, 2023, 546 days ago, MFC has delivered 74% since its addition to the Alpha Picks portfolio and more than 30% over the last year. Alpha Picks employs a systematic, data-driven selection process that allows previously chosen stocks to be reconsidered after one year in the portfolio. The strategy prioritizes stocks that maintain ‘Strong Buy’ ratings while demonstrating superior Quant Scores over a 75-day period, and MFC met these criteria.

Founded in 1887, Manulife has a significant presence in Asia, Canada, and the United States, where it operates primarily as John Hancock. The company offers a comprehensive suite of products and services, including:

Insurance: Life, health, and long-term care insurance for individuals and groups.

Wealth and Asset Management (WAM): Global investment management and retirement solutions for retail, institutional, and high-net-worth clients.

Annuities: Retirement income products.

Corporate and Other: Banking operations and legacy businesses.

Manulife’s business is highly diversified by geography and product line. The company’s strategy has increasingly focused on accelerating growth in its highest-potential businesses, especially in Asia and Global Wealth and Asset Management, while optimizing its portfolio for higher returns and lower risk.

MFC has also made significant strides as a digital transformation leader in the sector, with nearly $600 million invested in 2024 alone to enhance operational efficiency and customer experience. The company has launched advanced AI capabilities and digital platforms, contributing to improved customer satisfaction and operational efficiency.

Our Buy Thesis

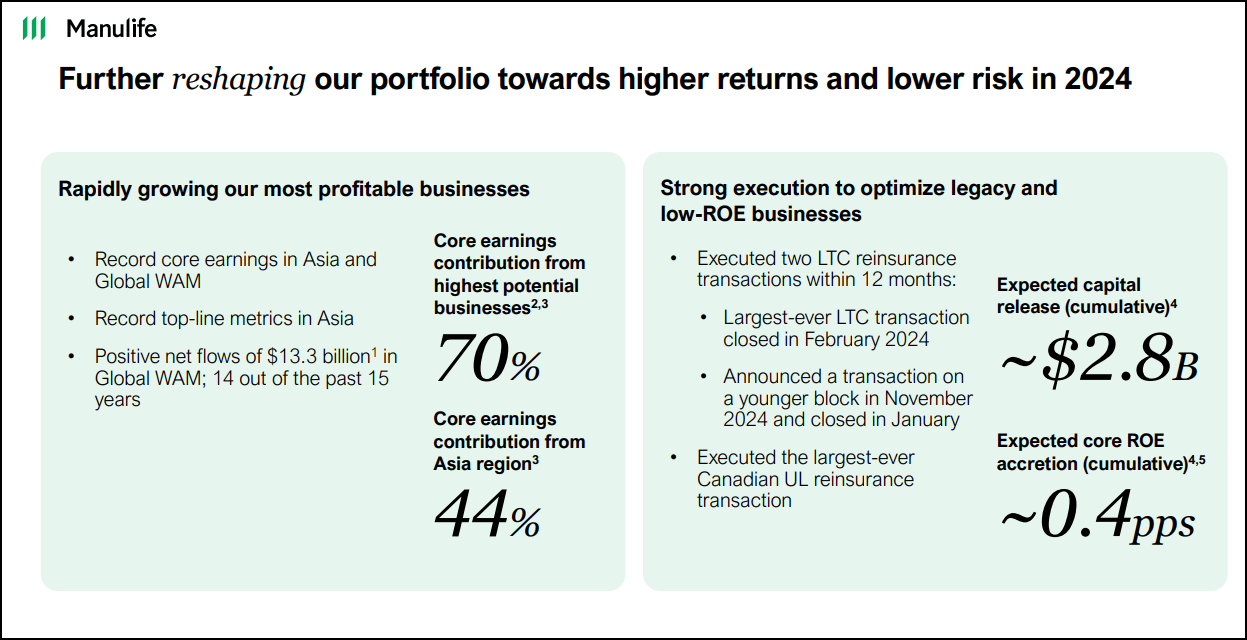

As mentioned above, MFC was originally added to the AP Portfolio 546 days ago—it has returned 74% since its addition to the Alpha Picks portfolio, including a gain of over 30% in the last 52-weeks. Despite the stock’s strong performance, the core fundamentals—growth, valuation, and profitability—remain solid and consistent. With earnings growth keeping pace with the share price, the stock's valuation has held steady. This strong alignment continues to support its inclusion in the Alpha Picks portfolio. Manulife's strategic focus on high-growth operations in Asia and its Global Wealth and Asset Management (WAM) division has yielded exceptional results, contributing to 70% of core earnings. This diversification not only stabilizes earnings across market cycles but also strategically positions Manulife to capture outsized growth in Asia's rapidly expanding markets.

Manulife's approach to capital optimization has demonstrated strong commitment to shareholder value through significant remittances, regular dividend increases, and substantial share buybacks. The company executed three major reinsurance transactions that will unlock $2.8 billion in capital while maintaining a strong LICAT ratio.

Manulife distinguishes itself through digital innovation, having made substantial investments in technology and artificial intelligence. These initiatives have transformed customer experiences and operational capabilities, creating a scalable platform for future expansion while improving overall efficiency. The company's commitment to technological advancement positions it well ahead of many competitors in the financial services industry.

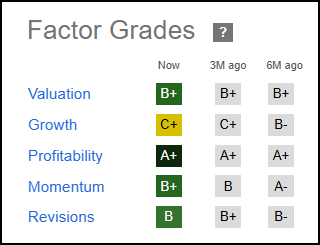

MFC Stock Factor Grades

Manulife Financial Growth & Profitability

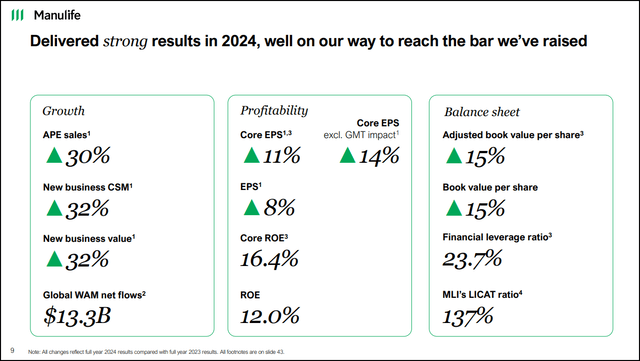

Manulife Financial delivered a standout year of growth in 2024, driven by exceptional performance in its highest-potential businesses. The company achieved record core earnings over $7B and core EPS rose 11%. Its Asia business continued to lead, posting a 27% increase in core earnings while Global Wealth and Asset Management (WAM) also delivered, ending the year with $13.3 billion in net inflows, a 290-basis-point increase in core EBITDA margin. Forward-looking growth metrics reflected in the company’s growth grade are also attractive with a FWD revenue growth of 15% which is more than 145% above the financial sector median.

The company’s ongoing digital transformation and customer-centric initiatives, including the rollout of advanced AI capabilities, contributed to operational efficiency and improved customer satisfaction, laying a robust foundation for sustained growth and profitability.

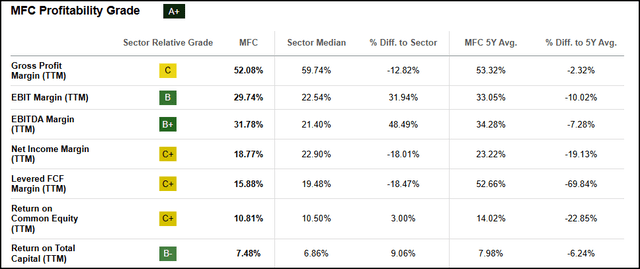

On the profitability front, Manulife expanded its core ROE to 16.4% for 2024, up from 15.9% the previous year, demonstrating clear progress toward its 18%+ target by 2027. The company maintained a disciplined focus on expense management, achieving an efficiency ratio of 44.8%, in line with its medium-term target. These gains are reflected in the company’s astonishing ‘A+’ Profitability grade.

MFC Profitability Grade

Manulife’s robust cash generation enabled record remittances of $7 billion, and it returned over $6 billion to shareholders through dividends and share buybacks, including a 10% dividend increase and the launch of a new buyback program. The company now sports a solid 3.84% FWD yield, underpinned by strong dividend growth and safety, and 24 consecutive years of dividend payments.

The balance sheet remained resilient, with a LICAT ratio of 137% and a leverage ratio of 23.7%, providing significant financial flexibility. These results underscore Manulife’s ability to deliver consistent profitability, strong capital returns, and sustainable value creation for shareholders—even amid ongoing macroeconomic uncertainty.

Manulife Financial Valuation

MFC trades at an solid discount, highlighted by an ‘B+’ overall valuation grade. Its Price/Cash Flow (TTM) ratio is 2.9x compared to the sector median of 9.4x, a 69% difference to the sector. Its FWD Price/Sales of 1x is also at a hefty 62% discount relative to other financials.

Potential Risks

Manulife is slated to undergo another leadership change in May, which can often introduce uncertainty to investors. As a financial services provider, MFC remains exposed to economic cycles, credit quality deterioration, and market volatility. Variable annuities can pressure capital during downturns. Rising U.S. tariffs on Canadian goods and energy, along with global trade tensions, are creating economic uncertainty and inflationary pressures, and could slow lending growth in Canada. As fear moves the markets, many investors are getting defensive or going to cash for fear of losing.

Concluding Summary

Manulife Financial has continued to thrive since its addition to the Alpha Picks portfolio in November 2023. The company delivered record results with strong performances in Asia and Global Wealth Management, which now contribute 70% of core earnings—alongside $7 billion in remittances and $13.3 billion in net inflows from the Global WAM business in 2024. With core EPS growth of 11%, an expanded core ROE of 16.4%, and strategic portfolio optimization through three major reinsurance transactions expected to release $2.8 billion in capital, Manulife demonstrates strong operational efficiency. The company remains committed to shareholder returns through a 10% dividend increase and the announcement of a new 3% share buyback program, all while maintaining a strong LICAT ratio of 137% and leveraging digital innovation that generated over $600 million in benefits in 2024 alone.

Trading at an attractive valuation despite exceptional profitability, Manulife's diversified portfolio offers investors protection against income volatility, while delivering a compelling forward dividend yield of 3.84% and 24 years of consistent payments. The company's operational efficiency, strategic focus on digital innovation (which generated $600 million in benefits in 2024), strong business momentum in Asia and Global WAM, and dominant market position across its key segments make MFC a standout choice for investors seeking both growth and income.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.