- Published on

[MU] High Bandwidth For A Bargain

- Authors

- Name

- Perpetual Alpha

Summary

- This pick is the only U.S.-based manufacturer of advanced memory chips essential for a wide range of technologies, including AI applications and advanced computing.

- As the #1 Quant-ranked semiconductor stock, this company notched record revenue of $37.4B, up 49% year-over-year for full-year 2025.

- Gross margins expanded 17 points to 41%, reflecting disciplined execution and premium product mix.

- A $200B U.S. expansion plan has the potential to further reinforce its position as an American chip hegemon.

- Diversified across data center, mobile, automotive, and embedded markets, this company is shielded from single-sector volatility.

Business Overview

Micron Technology, Inc. is a global leader in memory and storage solutions and the #1 Quant-ranked semiconductor stock. The company manufactures essential components that enable computers, smartphones, and data centers to store and rapidly access information. Its product portfolio includes dynamic random-access memory (DRAM), which allows devices to run multiple applications simultaneously; high-bandwidth memory (HBM), essential for AI applications requiring ultra-fast data processing; and NAND and NOR flash memory.

These technologies underpin a wide range of markets, including data centers, AI systems, high-performance computing, mobile devices, automotives, and consumer products. They power technologies from cloud computing to autonomous vehicles, making Micron’s products essential to the digital economy.

The company operates across several key segments: Cloud Memory, Core Data Center, Mobile & Client, and Automotive & Embedded. As of Q4 FY2025, Micron’s data center business accounted for a record 56% of total revenue, with gross margins of 52%.

Micron stands out as the only U.S.-based memory manufacturer, offering unique advantages in an industry increasingly shaped by geopolitical dynamics. The company’s focus on advancing memory technology—particularly in HBM and next-generation NAND—positions it to capture AI-driven growth and the broader digital transformation.

Our Buy Thesis

MU stands at the intersection of two powerful trends: artificial intelligence expansion and memory technology. As AI workloads explode across data centers and consumer applications, the company is uniquely positioned to capture outsized demand for high-bandwidth memory and advanced DRAM solutions critical to AI infrastructure.

However, the company's strategic positioning extends beyond AI enthusiasm. Micron serves diverse end markets, including automotive, industrial, and mobile, offering multiple avenues for growth. This diversification shields the company from single-market volatility while allowing it to capitalize on growth trends across sectors. MU has demonstrated pricing power and margin improvement as supply-demand dynamics tighten, particularly in high-value segments.

In June, the company announced a $200 billion expansion plan that will massively increase U.S. memory manufacturing and R&D, bringing advanced packaging capabilities onshore to support critical AI demands and national security. This investment is expected to create around 90,000 jobs, while strengthening America’s semiconductor supply chain. The strong backing from the Trump Administration, major tech CEOs, and federal incentives underscores Micron’s role in American innovation and economic growth.

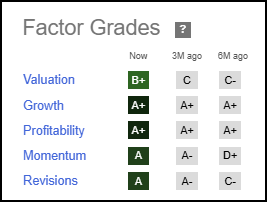

Seeking Alpha Factor Grades evaluate investment characteristics on a sector-relative basis. The company showcases incredible fundamentals, such as exceptional growth and profitability. MU also demonstrates excellent timeliness indicators, including an ‘A’ grade momentum and revisions grades.

Micron Technology Inc. Stock Factor Grades

MU Stock Growth and Profitability

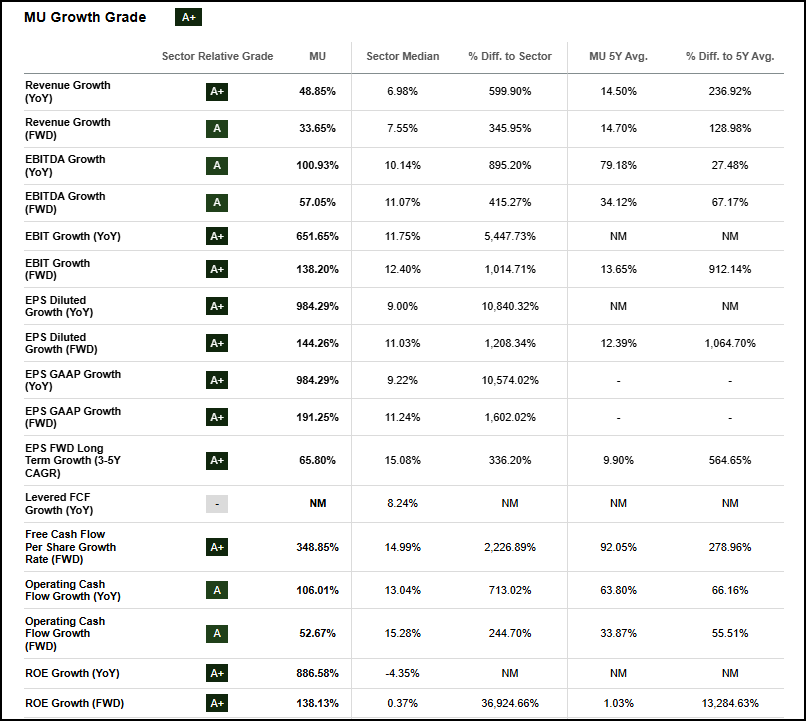

For Q4 FY2025, Micron achieved record revenue of $11.3 billion, up 22% from Q3 and 46% Y/Y, fueled by strong growth across data center, consumer, and automotive markets. DRAM revenue reached $9 billion, while the high-value HBM business posted a quarterly record of nearly $2 billion in revenue. For the full year, revenue surged 49% to a record $37.4 billion, once again driven by strong AI-related demand in data centers and across key end markets. These gains correspond to the stock’s ‘A+’ Growth grade, supported by promising short-term and long-term outlooks. The company showcases an EPS diluted FWD growth of 144% alongside an EPS FWD long-term growth (3-5Y CAGR) of 66%, which is more than 300% above the sector median.

MU Growth Grade

Profitability highlights include a consolidated gross margin of 45.7% (up 670 basis points sequentially) and non-GAAP EPS of $3.03, reflecting 59% sequential and 157% year-over-year growth. On a full-year basis, gross margin expanded by 17 percentage points to 41%, while EPS jumped 538% to $8.29, reflecting disciplined cost control and favorable pricing. The data center business accounted for a record 56% of company revenue and a 52% gross margin, while DRAM revenue climbed 62% to $28.6 billion, and NAND revenue rose 18% to $8.5 billion. Combined with healthy inventories, strong operating cash flow, and lower debt, these results highlight Micron’s momentum and resilience.

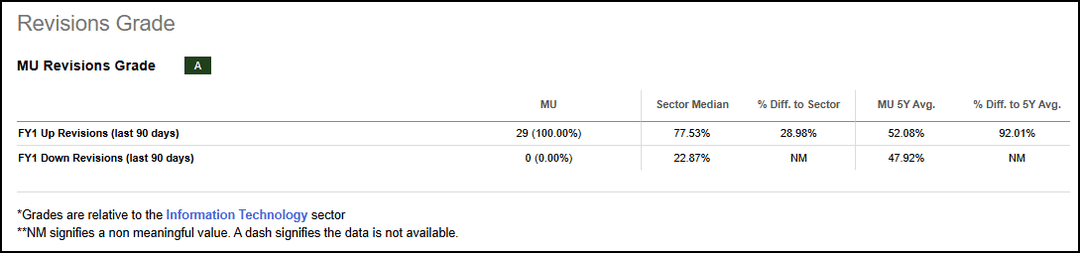

Micron's strong fundamentals have earned broad Wall Street support, with 29 analysts revising FY1 earnings estimates upward and zero downward.

MU Revisions Grade

MU Stock Valuation

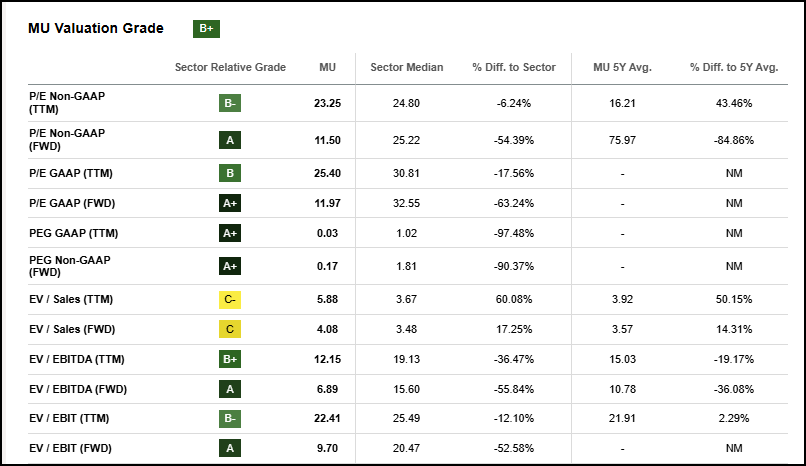

Micron’s valuation is where the company truly shines. Despite a 177% rally over the past six months, Micron’s valuation grade has improved from ‘C-’ to ‘B+’. This strength is reinforced by a set of deeply discounted valuation metrics, including a 0.2x forward PEG ratio, which is roughly 90% below the sector median. This highlights how attractively Micron is priced relative to its growth trajectory.

MU Valuation Grade

Potential Risks

Micron faces several key risks inherent to the volatile, capital-intensive semiconductor industry. Memory pricing cycles remain a key challenge, as oversupply or weak demand can rapidly erode margins. Geopolitical tensions, particularly between the U.S. and China, pose risks to supply chains and market access. Competition from Samsung and SK Hynix may pressure pricing and innovation timelines, especially in high-bandwidth memory. Additionally, large investments for advanced DRAM and NAND process transitions strain cash flow during downturns. Broader macroeconomic slowdowns and fluctuations in AI hardware spending could also weigh on near-term revenue outlooks. Stretched valuations across the AI sector could amplify volatility if investor sentiment shifts or growth expectations prove overly optimistic, affecting sentiment toward suppliers like Micron.

Concluding Summary

Micron Technology is the leading U.S.-based manufacturer of memory and storage solutions, supplying critical DRAM, NAND, and high-bandwidth memory for AI, data centers, and advanced computing. Its breadth of exposure across data center, mobile, automotive, and embedded markets supports growth diversification and resilience. For FY2025, revenue surged 49% to a record $37.4 billion, driven by AI-related demand, margin expansion, and strong pricing across high-value memory products. Supported by robust earnings growth, U.S. investment initiatives, and sector-leading valuations, Micron stands to benefit from AI-driven infrastructure expansion and high growth across its diversified suite of end markets.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.