- Published on

[TTMI] Critical Circuits: Powering Profitable Growth

- Authors

- Name

- Perpetual Alpha

Summary

- APP recently breached the 15% concentration limit for the AP portfolio. The position will be trimmed to 10%, and proceeds will be redistributed equally across other holdings.

- This allows the portfolio to manage risk while still benefiting from APP’s momentum and strong fundamentals.

- The October 1st Alpha Pick is a critical supplier across key growth markets, powering both next-gen AI infrastructure and mission-critical defense systems.

- Profitability is improving, with record EPS, strong cash flow, and four straight quarters of double-digit margins, driven by strong execution and a diverse product mix.

- Despite a +200% return in the last year, this company trades at a discount across key valuation metrics while receiving unanimous positive analyst revisions.

Alpha Picks Heavyweight Scaled Back to 10%

Since Alpha Picks launched on July 1, 2022, the portfolio has achieved remarkable gains, rising 252% compared to 76% for the S&P 500. Ten standout stocks have each delivered returns of over 100%. While big winners have driven outsized portfolio-level returns, stock positions that grow too large relative to other holdings can create risks, including:

- Higher volatility

- Heavier exposure to single-stock downturns

- Greater difficulty in fully replicating the portfolio

To manage these risks, Alpha Picks trims any stock that exceeds a 15% holding weight back to 10%, redistributing the excess return equally across the other holdings. This is a rare occurrence; the only other stock to surpass the concentration limit was Super Micro Computer, Inc. (SMCI), which delivered a 1,073% gain before being scaled back to 10% in March of 2024. This action was a routine risk control, not a reflection of SMCI’s fundamentals, and the remaining SMCI shares went on to deliver an additional 300% before the position was fully closed on October 30, 2024.

AppLovin (APP), one of Alpha Picks’ biggest winners, has recently breached the concentration limit. First selected on November 15, 2023, APP has skyrocketed 1,568%, driven by in-app monetization and AI-driven ad technology. The stock’s position will be trimmed back to 10%, ensuring the portfolio avoids overexposure while still benefiting from APP’s strong fundamentals and momentum.

Business Overview

Headquartered in Santa Ana, California, TTM Technologies (TTMI) is a leading global manufacturer, specializing in advanced technology solutions, mission systems, and electronic components. The company focuses on the design and production of radio frequency (RF) components, RF microelectronic assemblies, and technologically advanced printed circuit boards (PCBs) used in applications for a variety of end markets. TTM leverages its “time-to-market” delivery strategy, providing quick-turn, one-stop manufacturing services that enable customers to bring new products to market faster. By shortening development cycles, TTM helps clients accelerate breakthroughs, enhancing their competitive positioning.

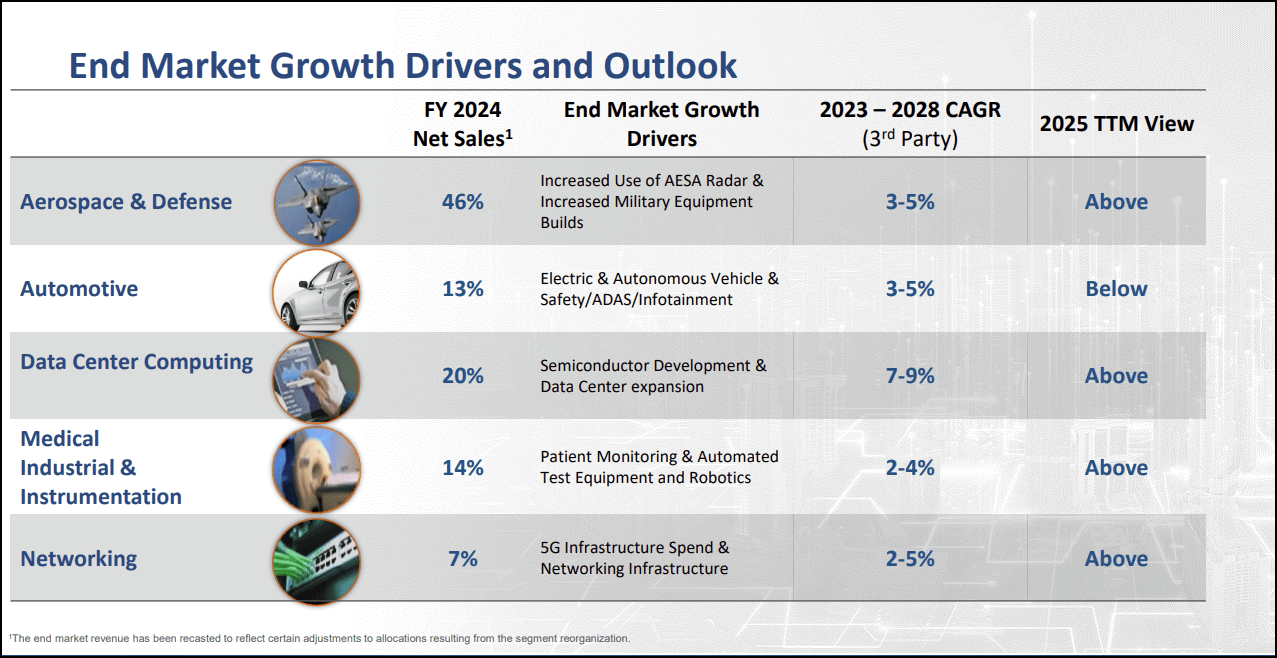

Aerospace and data center computing together made up about two-thirds of the company's revenue mix, with data center computing projected to be the main engine for future growth. This segment is expected to outpace others, driven by robust trends in semiconductor development and rapid data center expansion.

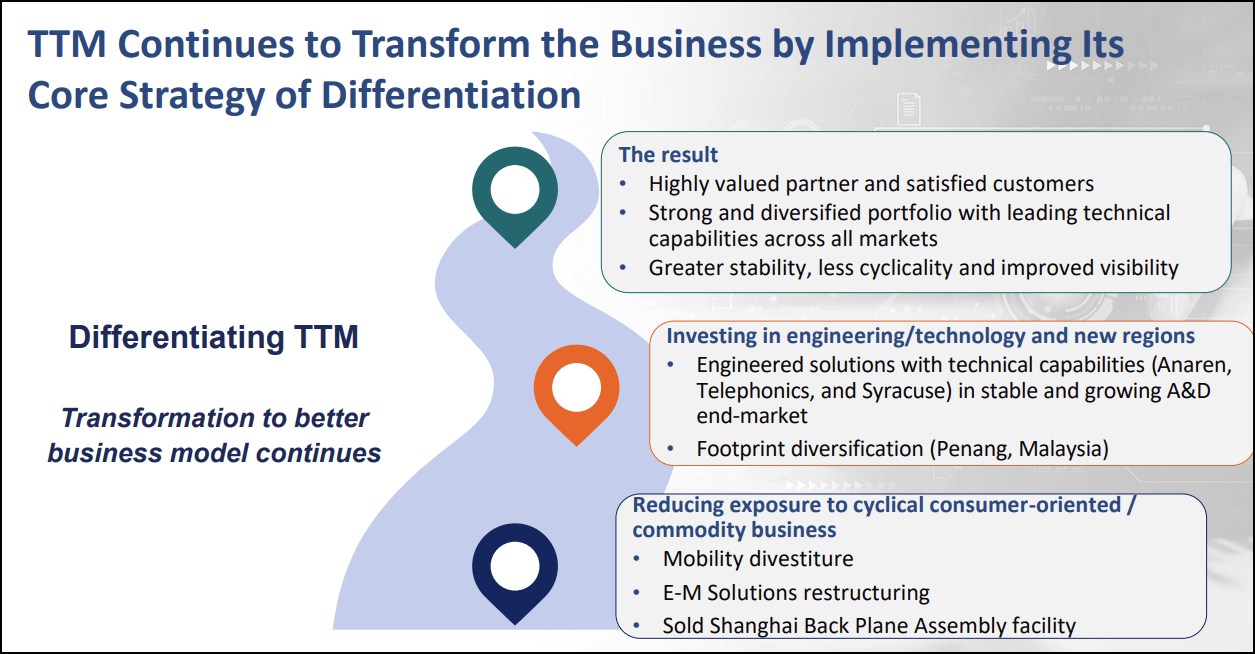

TTM’s strategic edge lies in its advanced manufacturing capabilities, global footprint, and broad customer base, which enable supply chain resiliency amid global trade uncertainty. The company’s focus on generative AI and mission-critical sectors further drives growth, supported by strategic acquisitions and margin expansion initiatives.

Our Buy Thesis

TTM Technologies stands out as a strategic supplier to some of the most critical and fast-growing industries in the global economy. Nearly half of the company’s revenue comes from the aerospace and defense segment, where it delivers advanced radar systems, secure communications, and electronics for leading defense programs like the F-35 and cutting-edge SPY-6 radar.

On the civilian side, TTM is increasingly supporting generative AI and hyperscale cloud infrastructure. Its sophisticated printed circuit boards and RF components are chosen by industry leaders across data center, networking, and AI hardware. The company has established critical partnerships with tech giants like Apple (AAPL), Cisco (CSCO), Tesla (TSLA), and defense industry giants like RTX Corporation (RTX).

TTMI’s one-stop manufacturing model ensures customers launch breakthrough products ahead of rivals, attracting those who need reliability and speed to market. Backed by rising demand in both defense and AI infrastructure, strong recent earnings momentum, and long-term relationships with blue-chip clients, TTM Technologies is exceptionally well placed to deliver sustained growth and outperformance.

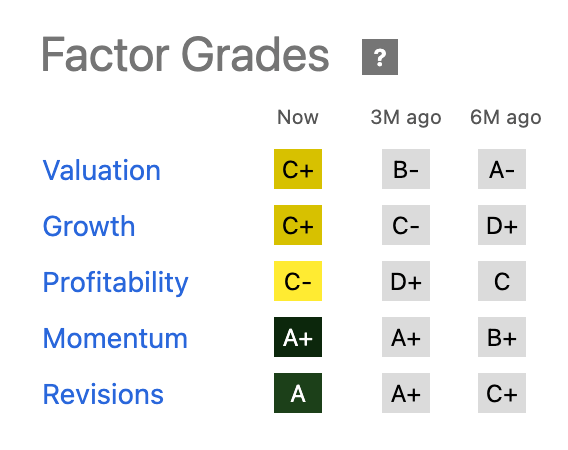

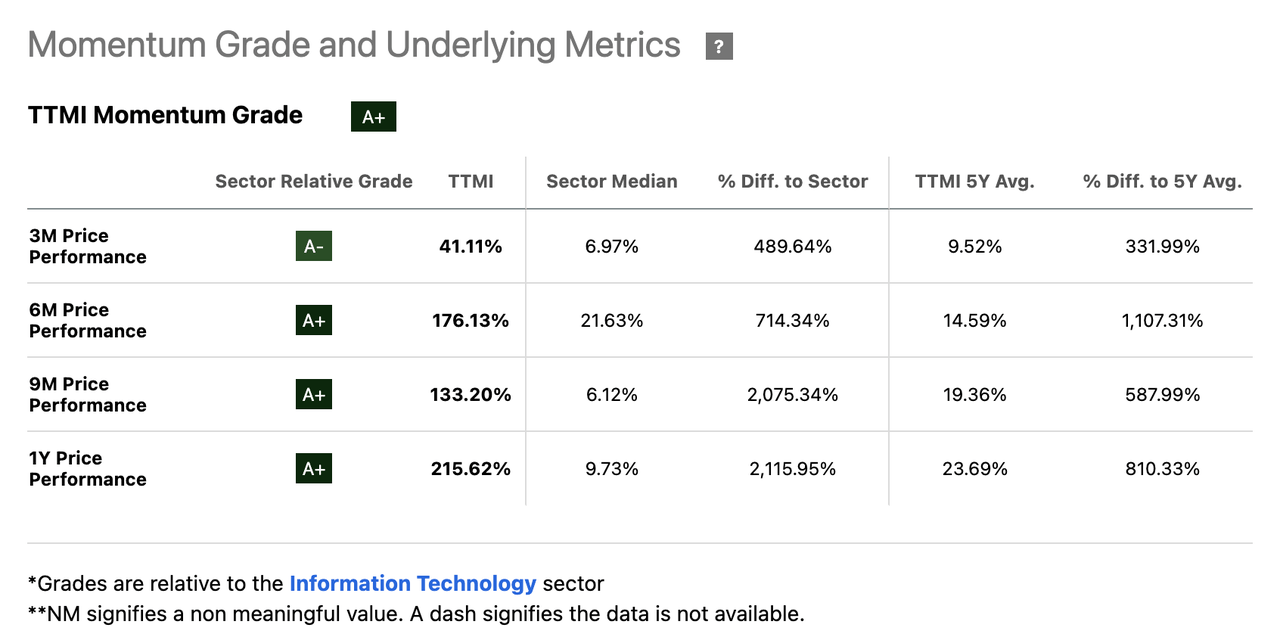

Seeking Alpha Factor Grades, which rate investment characteristics on a sector-relative basis, showcase TTMI’s impressive timeliness indicators, along with strong fundamental metrics that will be explored in more detail below. The company showcases ‘A+’ momentum, in addition to superior earnings revisions.

TTMI Stock Factor Grades

TTMI Stock Growth and Profitability

TTMI delivered impressive growth in Q2 2025, with revenue rising 21% year-over-year to $730.6 million, surpassing expectations. This growth was driven by strong demand across all segments, with the exception of its automotive division. Aerospace and defense accounted for a record 45% of total sales, supported by a robust $1.46 billion program backlog and surging defense budgets. Data center computing revenue, closely tied to generative AI, also grew 20% year-over-year and reached a new high, while networking revenue saw a remarkable 52% increase, reflecting strong demand for switch-related AI products. This diverse set of gains helped year-over-year ROE and EPS growth jump 429% and 441%, respectively.

From a profitability standpoint, the company has improved significantly, with non-GAAP operating margins rising to 11.1%, marking the fourth straight quarter of double-digit margin performance. Diluted EPS set a company record at $0.58, reflecting solid execution, improved product mix, and higher sales volumes. Strong cash flow from operations reached $97.8 million, and net leverage ended at a healthy 1.2x, underscoring improved cash generation and disciplined capital.

TTMI’s strengthening profitability is reflected in its Quant factor grades; the company has improved from a ‘D+’ just three months ago to its current ‘C-’ grade. When looking at underlying metrics, we observe that TTMI outpaces the sector across several critical data points: the company’s cash from operations and cash per share are 94% and 99% above the sector median, respectively.

TTMI’s astronomical growth and improving profitability have fueled strong price momentum, pushing its shares to dramatically outperform the broader sector. Over the past year, the stock has returned 216%, underscoring the strength of its rally and investor enthusiasm.

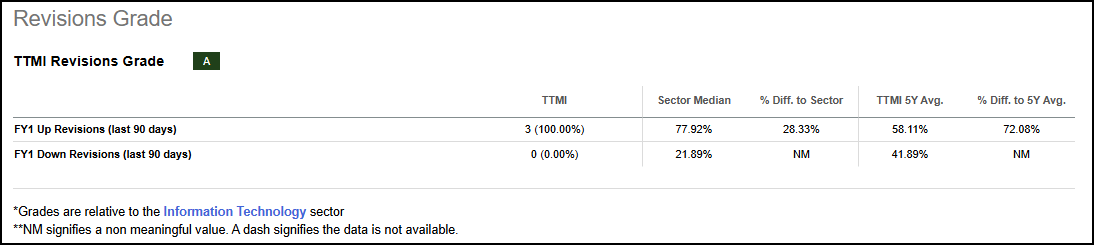

TTMI Momentum Grade This compelling mix of investment attributes has driven four upward analyst estimate revisions in the past 90 days, with zero downward.

This compelling mix of investment attributes has driven four upward analyst estimate revisions in the past 90 days, with zero downward.

TTMI Revisions Grade

TTMI Stock Valuation

Considering the stock’s substantial appreciation over the past year, its valuation framework remains impressive. Its grade has only modestly shifted from a ‘B-’ three months ago to its current ‘C+.’ A look at the company’s underlying metrics reveals that the stock still trades at a meaningful discount across key metrics, including its TTM PEG, which reflects an 85% discount, and its forward price-to-sales, where it is nearly 40% below the sector median.

Potential Risks

TTMI’s aggressive acquisition and divestiture strategy brings integration challenges, a key risk that could disrupt operations and ultimately harm its financials. The company also relies heavily on sectors like aerospace, defense, and AI, making it vulnerable to fluctuations in government and industry demand. Competitive pressures, market volatility, and shifting product mixes could compress margins or hinder growth. Geopolitical instability, interest rate changes, currency swings, and broader economic uncertainties pose further threats to profitability and demand. Additionally, TTMI is exposed to supply chain disruptions and international tensions, both of which may impact production and overall financial health. An upcoming CEO transition by year-end introduces further uncertainty around the company’s leadership direction and investor confidence.

Concluding Summary

TTM Technologies is a global leader in advanced technology manufacturing, serving critical sectors like aerospace, defense, and data center computing. The company’s innovative time-to-market strategy, diversified customer base, and global footprint support supply chain resilience and robust growth, even amid sector and macroeconomic risks. In Q2 2025, TTMI delivered record performance with 21% year-over-year revenue growth, substantial profit margin gains, and strong demand across both defense and AI infrastructure markets. Thanks to its execution, partnerships with leading tech and defense companies, and momentum in mission-critical end markets, TTM Technologies is well-positioned to navigate challenges and continue outperforming peers within the AI hardware sector.

For Alpha Picks investors with a fixed amount of capital who are looking for a more active approach, consider the PRO Quant Portfolio (PQP). PQP delivers a disciplined, data-driven, systematic model portfolio. Like Alpha Picks, PQP is powered by Seeking Alpha's proprietary Quant system. The portfolio draws from nearly 5,000 U.S.-listed stocks and ADRs worldwide, selecting top opportunities based on rigorous multi-factor selection. PQP holds 30 equal-weighted positions, rebalanced weekly to reflect updated ratings and market conditions. Subscribers receive weekly alerts on all trades and detailed analysis from the Quant Team, making it easy to follow or use as an idea generator.

Author

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha