- Published on

[CDE] A Shining Prospect

- Authors

- Name

- Perpetual Alpha

Summary

- Benefitting from a supportive environment for precious metals, this company’s North American focus helps minimize geopolitical risk relative to other miners.

- This company posted record Q2 2025 revenue of $481M, a 117% year-over-year jump, and achieved net income of $127M, with a 51% EBITDA margin.

- Gold and silver production saw double-digit growth, with operational improvements at Rochester and Las Chispas driving a major boost in output.

- This company has notched ‘A+’ grade momentum and exceptional analyst sentiment from strong operational achievements.

- The Alpha Picks portfolio continues to soar, having returned an incredible 240% since its inception in July 2022.

Business Overview

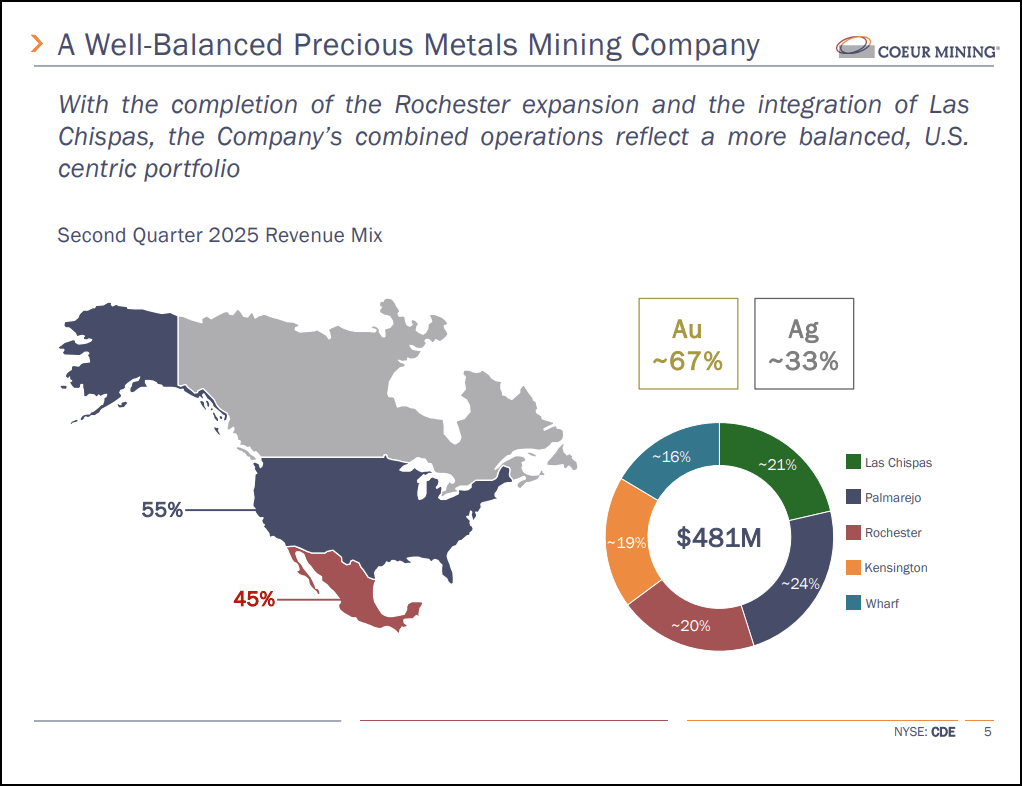

Coeur Mining, Inc. (CDE) is a U.S.-based diversified precious metals producer with five wholly owned operations spanning the United States, Canada, and Mexico. Coeur’s operations focus on high-grade, high-margin mines with ongoing investments in exploration and process innovation. This focus is evidenced by its recent acquisition of SilverCrest and the integration of Las Chispas, one of the world’s highest-quality silver producers. Compared to other Alpha Pick gold stocks, such as Kinross (KGC) and SSR Mining (SSRM), Coeur stands out for its portfolio concentration in North American operations, reduced political risk, and higher production of silver.

Source Link: Coeur Mining Q2 Earnings Presentation

CDE has differentiated itself by embracing advanced automation and digital monitoring at its Rochester mine, enabling rapid data analysis and operational efficiency through centralized systems. The company is also expanding sustainability initiatives, such as water conservation efforts and mine optimization projects, reflecting its commitment to responsible mining and ongoing improvement. Additionally, Coeur’s focus on standardizing best practices and data management across its operations helps ensure quality control and adaptability across the business.

Our Buy Thesis

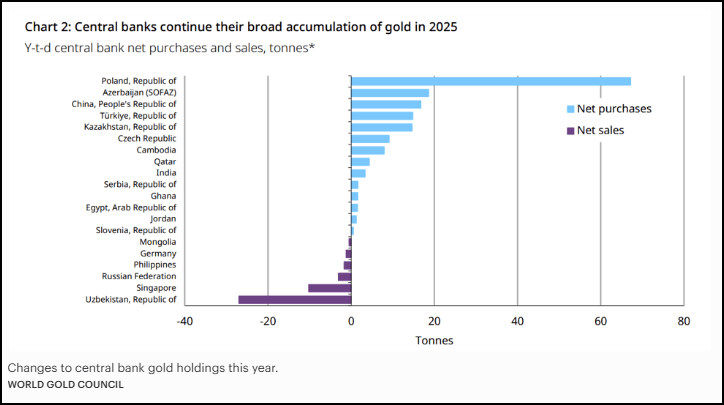

As we’ve recently covered, gold stocks are well-positioned right now due to rising prices driven by Fed rate cut expectations, robust central bank demand, and ongoing global uncertainties.

Central Banks are Contributing to Supportive Gold Prices

Gold miners have benefited from strong profits and improved margins, with many outpacing the gains in gold itself. Not every miner is equally positioned. However, companies with efficient operations and active growth projects, such as CDE, stand to gain the most from supportive gold fundamentals and bullish macro trends. CDE's recent operational improvements, expanding production, and financial strength put it among the sector’s top opportunities going forward.

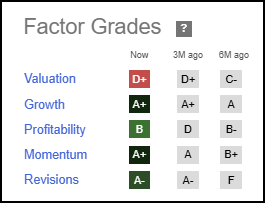

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. The company exhibits strong fundamentals, such as exceptional growth and solid profitability. CDE also showcases excellent timeliness indicators, including an ‘A+’ momentum.

CDE Stock Factor Grades

CDE Stock Growth and Profitability

Coeur Mining posted record results in the second quarter of 2025, with revenue reaching $480.7 million, a 117% increase year-over-year, and net income climbing to $127M. The company reported free cash flow of $146 million, while adjusted EBITDA surged to $243.5 million, amounting to a 51% margin. From a Quant perspective, CDE’s ‘A+’ growth is supported by exceptional backward- and forward-looking metrics, including triple-digit year-over-year and forward EBITDA growth.

Operational improvements, particularly at the Rochester and Las Chispas mines, drove a double-digit gold and silver production boost. Coeur’s financial position was further strengthened by initiating a $75 million share buyback, fully repaying its $110 million revolving credit facility, and raising full-year guidance for both EBITDA and cash flow.

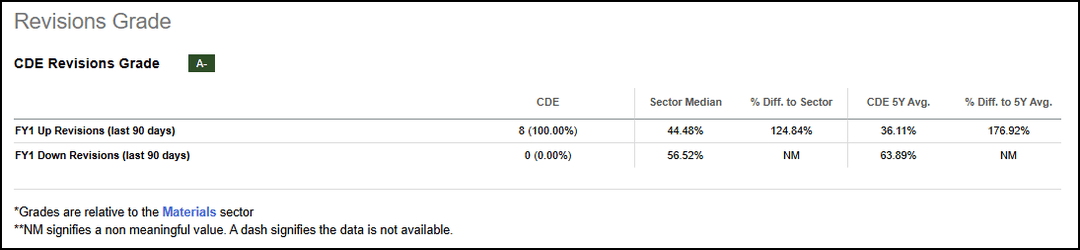

CDE’s impressive ‘A’ grade price momentum (+129% TTM) has fueled a wave of positive analyst earnings revisions, pushing its consensus EPS revision grade up to ‘A-.’

CDE Revisions Grade

Positive analyst sentiment and exceptional momentum serve as impressive timeliness indicators, rounding out the company’s fundamental strength.

CDE Stock Valuation

Like many gold stocks, CDE’s valuation has stretched following the metal’s recent rally. However, a closer examination of the company’s valuation framework shows that CDE currently trades broadly in line with sector peers on key metrics, such as forward price-to-earnings, suggesting its valuation premium is largely in step with the broader gold mining sector.

Potential Risks

The company is sensitive to swings in gold prices, with fluctuations in the precious metals market having a direct effect on both revenues and profit margins. Specific risks for CDE include operational challenges at key sites, such as the threat of permitting delays or environmental issues, which could disrupt production schedules and elevate costs. Additionally, integration risks remain following recent acquisitions, and any setbacks at new developments or from regulatory actions could materially impact near-term results and project timelines. While CDE is less exposed to geopolitical risks compared to other gold miners, negative developments in US-Mexico relations could materially impact the company, as a significant portion of its revenue is generated from Mexican operations, including key assets like Palmarejo and Las Chispas.

Concluding Summary

Coeur Mining, Inc. is a U.S.-based precious metals producer emphasizing high-grade assets and process innovation, including the recent integration of Las Chispas, a top-tier silver mine. CDE has benefitted from impressive financial and operational gains, including record revenue, strong profits, and rising gold and silver production, in addition to ongoing process improvements and cost controls. This positive momentum has been amplified by a historically supportive environment for gold, with metal prices strengthened by expectations for Fed rate cuts, robust central bank buying, and heightened global economic uncertainty—factors that typically fuel investor interest in gold and gold miners. The company’s solid price momentum has earned it unanimous endorsements from Wall Street analysts, with eight FY1 upward revisions and zero downward. Though recent gains have stretched its valuation, CDE still trades largely in line with sector averages based on forward earnings.

For Alpha Picks investors with a fixed amount of capital who are looking for a more active approach, consider the PRO Quant Portfolio (PQP). PQP delivers a disciplined, data-driven, systematic model portfolio. Like Alpha Picks, PQP is powered by Seeking Alpha's proprietary Quant system. The portfolio draws from nearly 5,000 U.S.-listed stocks and ADRs worldwide, selecting top opportunities based on rigorous multi-factor selection. PQP holds 30 equal-weighted positions, rebalanced weekly to reflect updated ratings and market conditions. Subscribers receive weekly alerts on all trades and detailed analysis from the Quant Team, making it easy to follow or use as an idea generator.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.