- Published on

[KGC] Gold Standard Growth

- Authors

- Name

- Perpetual Alpha

Summary

- Favorable gold market dynamics benefit this materials stock, with safe-haven demand surging as global risks and macro uncertainties persist.

- This company showcases excellent profitability, boasting an ROE 345% above the materials sector and a 26% levered cash flow margin.

- Powerful sector-relative momentum is dovetailed by attractive valuation metrics, including a FWD PEG that is 38% discounted to the sector.

- This company’s yield is supported by a low payout ratio and backed by consecutive dividend payments.

Business Overview

Kinross Gold Corporation (KGC) is the #6 Quant-ranked materials stock and a leading global gold mining firm engaged in the exploration, development, and production of gold. Over 95% of its revenue is generated from gold sales, including the production and sale of semi-pure gold doré bars.

Kinross operates several major mining sites across the Americas and West Africa, with flagship mines such as Bald Mountain in Nevada and the Great Bear project in Ontario. Bald Mountain stands out for its vast resource base and efficient heap leach infrastructure, enabling phased developments that lower capital risk and extend mine life. The Great Bear project offers high-grade gold resources with substantial exploration upside, employing both open-pit and underground mining strategies for production flexibility and resource expansion.

Kinross has been recognized for its strong sustainability performance, receiving the Outstanding Business Achievement in Sustainability Award from the Canadian Council for the Americas in 2024. UBS’s recent Buy rating and $20 price target reflect confidence in supportive gold prices, as well as Kinross’s operating momentum, and accelerating cash returns, setting it apart from peers through a combination of financial discipline and responsible mining.

Our Buy Thesis

KGC is backed by favorable market dynamics and robust company-specific strengths. The backdrop for gold has been highly supportive, with rising geopolitical tensions, concerns over central banking independence, and persistent inflation reinforcing gold's role as a safe-haven asset. Recent moves by President Trump have stoked fears of a weaker dollar, sending gold prices near all-time highs.

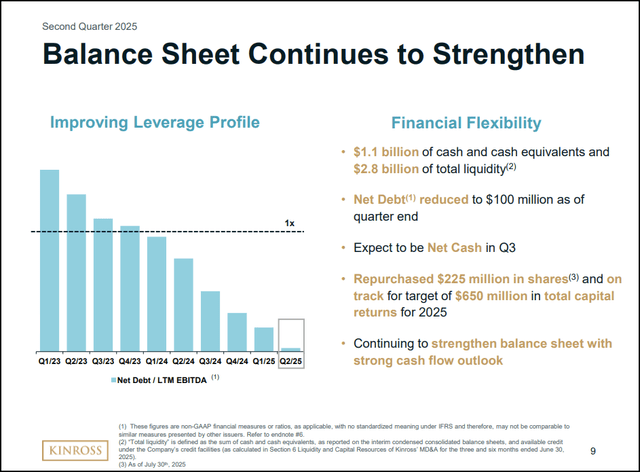

Kinross is distinguished by its production profile, industry-leading cost discipline, and shareholder-friendly capital allocation. The company's mines, such as Paracatu, Tasiast, and La Coipa, generated substantial production at competitive costs, supporting full-year guidance of two million ounces. KGC maintains an excellent balance sheet, with net debt reduced to $100 million as of Q2 and an expectation of net cash in Q3, while returning capital aggressively through dividends and a $650 million buyback program.

Altogether, Kinross is uniquely positioned to capture gold's structural upside through disciplined execution, a deep pipeline, and growing shareholder returns.

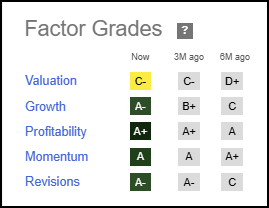

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. The company exhibits phenomenal fundamentals—including solid growth and exceptional profitability. KGC also showcases excellent timeliness indicators with ‘A’ grade momentum and earnings revisions.

KGC Stock Factor Grades

KGC Stock Growth and Profitability

In Q2 2025, KGC posted a record free cash flow of $647 million for the quarter and over $1 billion for the first half of the year. This performance was driven by strong gold prices and excellent production execution. Adjusted earnings reached $0.44 per share, while operating cash flow climbed to $844 million, underscoring the company’s ability to generate capital. Kinross also continued its industry-leading margin expansion, delivering margins of over $2,200 per ounce, well ahead of gold price appreciation. Notably, CEO Paul Rollinson commented on the Q2 earnings call:

Our strong production and cost management, combined with the gold price, resulted in record operating margins. As a result, we also delivered record free cash flow in the second quarter of almost $650 million and a first half total of just over $1 billion. Our financial position and cash flow outlook remain excellent, and we plan to continue to return meaningful capital to shareholders through ongoing share repurchases and our quarterly dividend.

This financial resilience and effective margin management underpin Kinross’s status as a premier gold miner, which is evidenced by the company’s Quant Growth and Profitability grades.

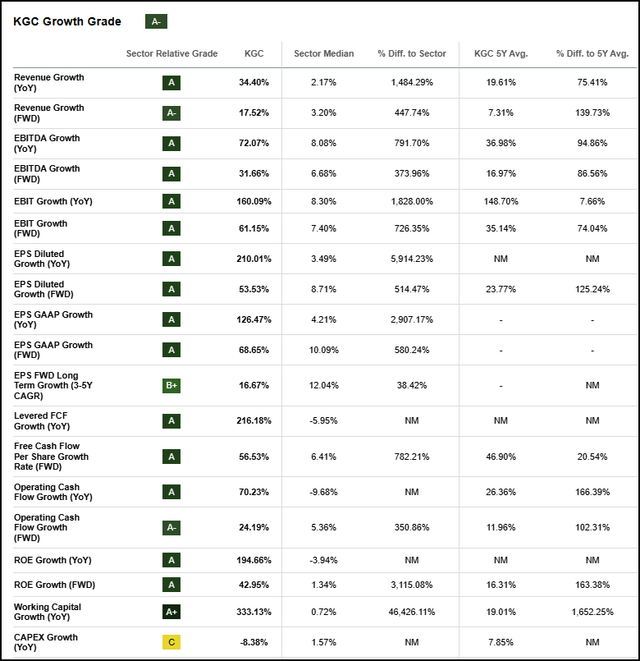

KGC showcases excellent sector-relative growth, with notable highlights, including an EPS FWD growth that is 514% above the sector median and a Y/Y operating cash flow growth of 70%.

KGC Growth

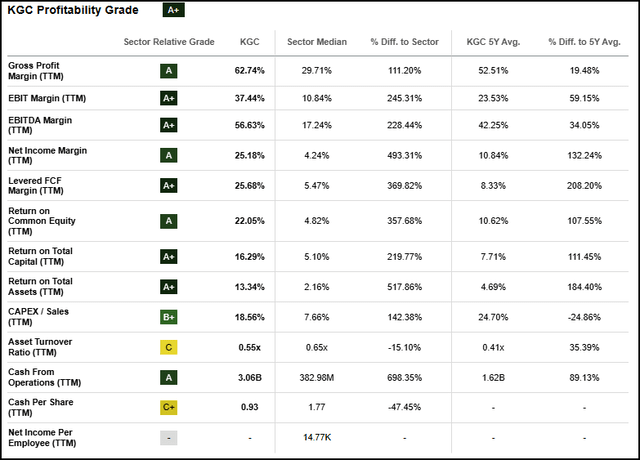

KGC is also a standout in terms of profitability. Despite the industry's high cyclicality, Kinross has managed to meet or beat EPS expectations in 10 out of the last 11 quarters. The company sports a 22% ROE that is 357% above the materials sector, as well as an incredible 26% levered cash flow margin vs. the sector’s 5.47%.

KGC Profitability Grade

KGC’s remarkable price momentum (+132% TTM) has contributed to unanimous positive earnings revisions, resulting in an ‘A-’ EPS revision grade.

KGC Stock Valuation

Kinross Gold Corporation’s valuation is currently in line with the broader sector and has demonstrably improved from its ‘D+’ grade just three months ago. The company scores well on traditional valuation metrics such as its (TTM) price/earnings GAAP ratio, which is 31% below the sector median. The company is also trading nearly 40% below the sector median in terms of its FWD PEG ratio, meaning it is even more attractive when adjusting for its anticipated earnings growth—making Kinross compelling for growth-aware value investors. While Kinross offers a modest yield, its dividend is well-supported by robust safety and growth metrics, including four consecutive years of dividend payments and a payout ratio of just 10%.

Potential Risks

As a fintech company, Paypal faces increasing competition from tech giants, such as Apple Pay, and fintech startups that could erode market share and pressure margins. The company’s reliance on lower-margin products like Venmo has the potential to impact profitability over the long term. Macroeconomic factors, including lingering inflation, could threaten consumer spending and transaction volumes. The fintech industry is under increasing regulatory scrutiny, which could also have adverse implications for the company if major changes to the regulatory environment impact operations or profitability. Cybersecurity threats and system-wide technical issues also have the potential to disrupt business, as was the case in late November. However, the company’s team of experts was able to resolve the issue within an hour.

Concluding Summary

PayPal has demonstrated resilience and adaptability since its inception in 1998, solidifying its position as a digital payment leader. The company’s recent pivot towards becoming a comprehensive commerce platform has yielded impressive results, with growth in total payment volumes by 9% and total revenue increasing by 6%. PYPL’s innovative initiatives, such as PayPal Everywhere, have enhanced user engagement, while key partnerships are slated to expand the company’s total addressable market and augment transaction volume.

The company's strong fundamentals are reflected across multiple factors, including growth, profitability, and revision. It has outperformed both the broader market and XLF- Financial Sector SPDR ETF, 49% vs. 29% respectively, over the past year.

We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like. The Alpha Picks Team wishes you PYPL the best in your investment journey. Happy investing.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.