- Published on

[COMM] High-Speed Returns Without The Premium Price

- Authors

- Name

- Perpetual Alpha

Summary

- This company delivered explosive 32% revenue growth in Q2 2025, with all segments posting double-digit gains and adjusted EBITDA up 79% Y/Y.

- A $10.5B divestiture will eliminate all debt and enable substantial dividends, transforming the company’s profitability and value for shareholders.

- Exhibiting exceptional fundamentals, this company sports a FWD EPS growth 220% above the sector median and five consecutive quarters of improving EBITDA.

- This tech company maintains an incredible valuation despite 345% TTM price momentum, with a P/S ratio at a 79% discount to the sector and 0.3x forward PEG.

Business Overview

In addition to being the #1 Quant-ranked Information Technology stock, CommScope Holding Company Inc. (COMM), a leading provider of network infrastructure solutions, also ranks among SA Quant’s TOP 10 Stocks for H2 2025 and the PRO Quant Portfolio. This trifecta of distinctions underscores the company’s exceptional fundamentals and growth prospects.

CommScope builds and supports the technology infrastructure that powers internet, wireless, and business connectivity. The company makes fiber optic cables, wireless equipment, and network management software that help deliver broadband and enterprise communications.

COMM operates across three major segments.

Connectivity and Cable Solutions (CCS): Produces the physical cables and connectivity products that carry internet and data for telecom operators, broadband providers, and cloud/data centers.

Access Network Solutions (ANS): ANS builds equipment for delivering TV and internet through cable networks; this includes amplifiers, nodes, and DOCSIS systems for broadband upgrades.

RUCKUS: Focuses on enterprise networking, including advanced Wi-Fi solutions (such as Wi-Fi 7), cloud-based management, and vertical markets like hospitality and multi-dwelling units.

COMM serves a wide range of global clients, including major telecom operators like AT&T (T) and T-Mobile (TMUS) as well as cable and broadband providers. It also works with large distributors and enterprise customers across industries like healthcare, hospitality, education, and government, often through direct contracts or partnerships.

This broad and diverse customer base underscores CommScope’s strong industry reputation and long-term relationships in telecom, broadband, and enterprise networking. The company’s depth of technical expertise, broad global presence, and focus on high-growth networking trends make it well-positioned within the rapidly evolving connectivity solutions industry.

Our Buy Thesis

COMM benefits from several robust growth catalysts and favorable financial developments. On August 4th, a definitive agreement was announced for the sale of its CCS division to Amphenol (APH). This strategic transaction, which is expected to close in H1 2026, will unlock approximately $10B in cash after taxes and transaction costs. This transformational deal, which immediately strengthens the company’s balance sheet and resolves historical leverage concerns, caused the stock to surge 80% the day of the announcement.

“With the net proceeds of approximately $10B, we expect to repay all of our debt and redeem our preferred equity. With our excess cash and modest leverage on the remaining company, we plan to distribute the excess cash to our shareholders as a dividend within 60 to 90 days of the transaction closing,” said President, CEO, & Director Charles L. Treadway.

COMM’s remaining segments also experienced explosive growth in Q2. The ANS segment was driven by strong demand for DOCSIS 4.0 upgrades and record deployments of amplifiers and nodes. Ruckus revenues also surged, propelled by the launch of new Wi-Fi 7 products, recovering demand after inventory normalization, and expansion into verticals like hospitality and multi-dwelling units.

With a strengthened capital structure and the promise of substantial shareholder returns, CommScope is well-positioned for future gains.

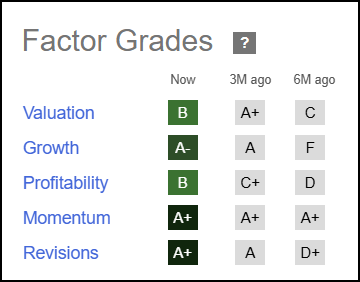

Seeking Alpha Factor Grades rates investment characteristics on a sector-relative basis. The company exhibits excellent fundamentals, including rock-solid profitability and strong growth. Notably, the company maintains a discounted valuation despite its ‘A+’ momentum.

COMM Stock Factor Grades

COMM Stock Growth and Profitability

In Q2 2025, CommScope delivered an incredible 32% Y/Y revenue growth, with all three business segments contributing double-digit revenue gains. The ANS segment surged 65%, while RUCKUS rose 47%, driven by Wi‑Fi 7 product launches and vertical market expansion. CCS grew 20%, fueled by an astonishing 85% jump in enterprise fiber sales for cloud and hyperscale data centers.

Source Link: COMM Q2 2025 Investor Presentation

From a Quant perspective, the company showcases excellent sector-relative growth, with notable highlights, including an EPS FWD Long-Term Growth (3-5Y CAGR) that is 189% above the sector median and an Operating Cash Flow Growth of 264%.

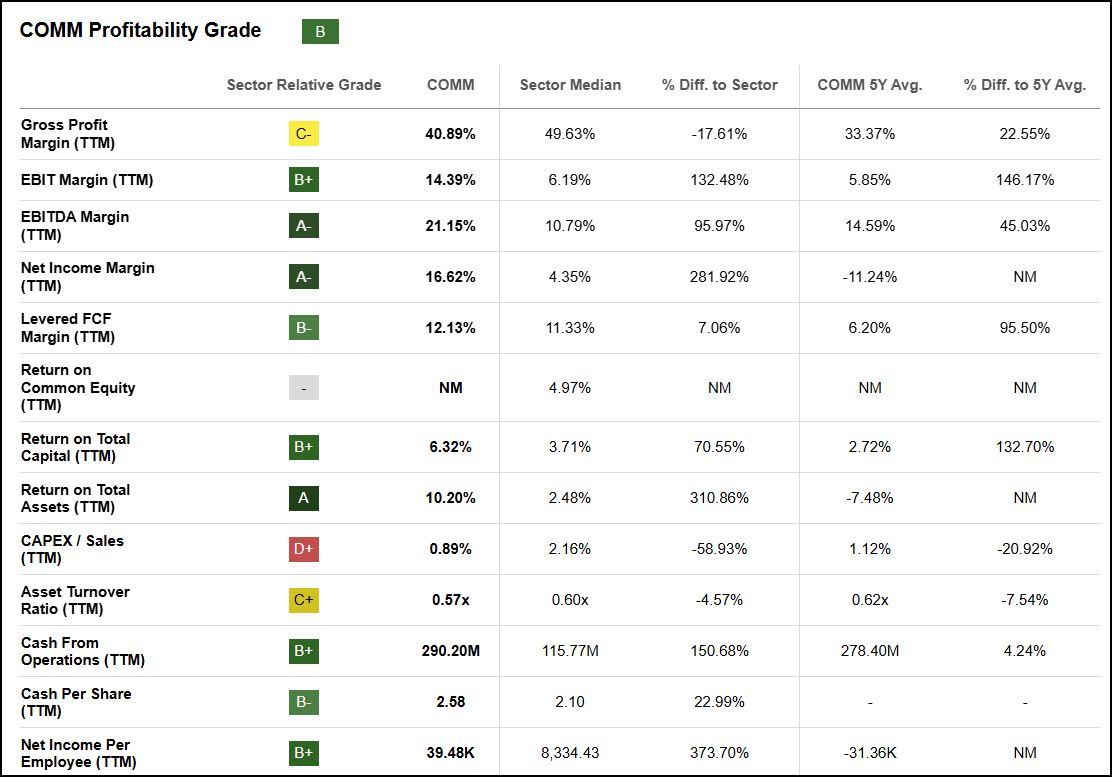

Adjusted EBITDA climbed Y/Y to $338 million, a 79% increase. The company has now posted five straight quarters of sequential EBITDA improvement, supported by favorable product mix, scale efficiencies, and cost control. These gains are reflected in the stock's improving profitability grade, which has risen from a 'D' six months ago to a 'B' today.

COMM Profitability Grade

COMM’s price momentum (+345% TTM) coupled with explosive growth and profitability has driven unanimous positive earnings revisions, resulting in an ‘A+’ EPS revision grade.

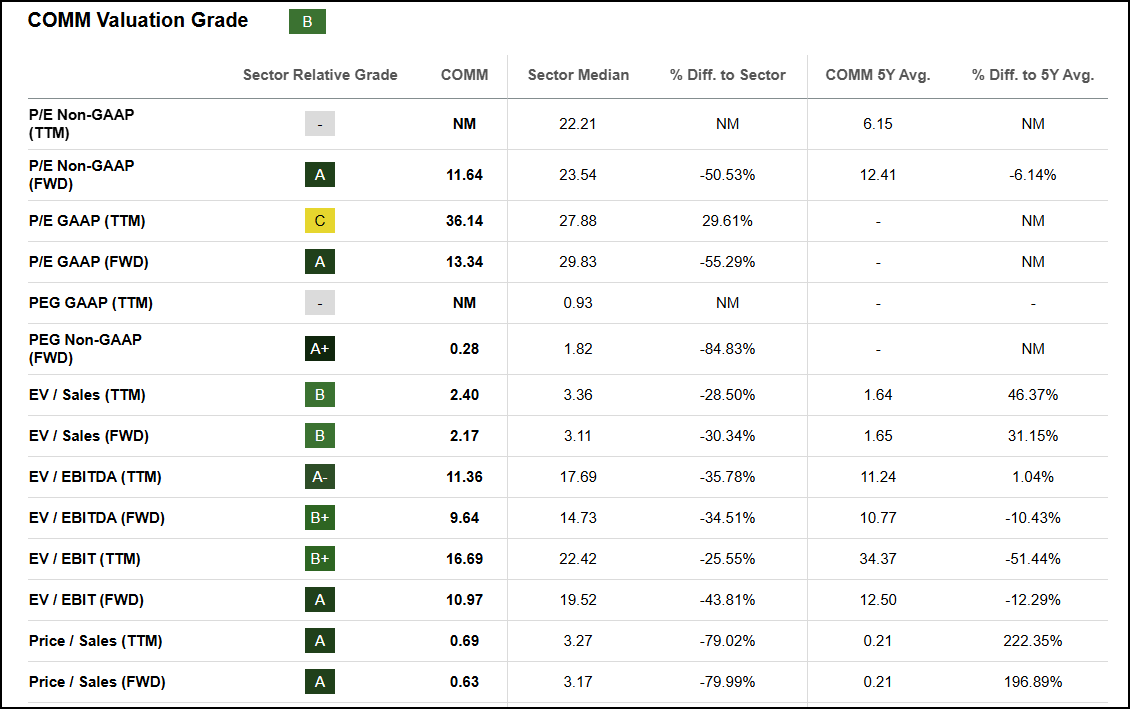

COMM Stock Valuation

CommScope’s valuation is a tremendous feat in light of its recent gains; the company’s grade has improved from a ‘C’ six months ago to a ‘B’ currently. COMM scores well in terms of both traditional metrics, like its Price/Sales, which is a 79% discount to the sector, as well as less conventional measures, like its 0.3x FWD PEG.

COMM Valuation Grade

Potential Risks

Major risks facing COMM center on execution and business transformation. The company's pending +$10B divestiture creates uncertainty around transferring assets, maintaining customer relationships, and deciding how to use the sale proceeds. As COMM focuses on its smaller ANS and RUCKUS segments, growth depends heavily on sustained demand for cable upgrade technology (DOCSIS 4.0) and advanced Wi-Fi products, both of which face intense competition. Additionally, economic factors like interest rates, tariffs, and supply chain disruptions could hurt profitability and cash flow while the company manages restructuring costs.

Concluding Summary

CommScope (COMM) stands out as the #1 Quant-ranked Information Technology stock and ranks among SA Quant's TOP 10 Stocks for H2 2025, driven by a transformational $10.5B sale of its CCS division to Amphenol. This divestiture will substantially strengthen the company’s balance sheet, enabling generous shareholder dividends.

The company delivered an explosive Q2 2025 performance with 32% revenue growth across all segments, led by ANS (65% growth) and RUCKUS (47% growth), while adjusted EBITDA climbed to $338M. From a fundamental perspective, the company exhibits exceptional sector-relative growth, with EPS forward long-term growth 189% above the sector median and operating cash flow growth of 264%, complemented by five consecutive quarters of EBITDA improvement. Despite its remarkable 345% trailing twelve-month price momentum, the stock maintains an attractive valuation with a Price/Sales ratio at a 79% discount to the sector and a forward PEG of just 0.3x.

For Alpha Picks investors with a fixed amount of capital who are looking for a more active approach, consider the PRO Quant Portfolio (PQP). PQP delivers a disciplined, data-driven, systematic model portfolio. Like Alpha Picks, PQP is powered by Seeking Alpha's proprietary Quant system. The portfolio draws from nearly 5,000 U.S.-listed stocks and ADRs worldwide, selecting top opportunities based on rigorous multi-factor selection. PQP holds 30 equal-weighted positions, rebalanced weekly to reflect updated ratings and market conditions. Subscribers receive weekly alerts on all trades and detailed analysis from the Quant Team, making it easy to follow or use as an idea generator.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.