- Published on

[STRL] AI's Profitable Foundation

- Authors

- Name

- Perpetual Alpha

Summary

- First added to Alpha Picks in August 2023, this company has ascended to the Alpha Picks’ Winners Circle, returning an incredible 320% since its addition.

- Data center revenue surged 60% year-over-year and now represents 65% of the company’s E-Infrastructure backlog, driving the segment's exceptional growth.

- Earnings have consistently exceeded expectations for 17 consecutive quarters, with 29% EPS growth in Q1.

- Despite nearly 130% TTM returns, this pick trades at a 66% discount based on the trailing twelve-month PEG ratio, suggesting more runway for this industrial stock.

Business Overview

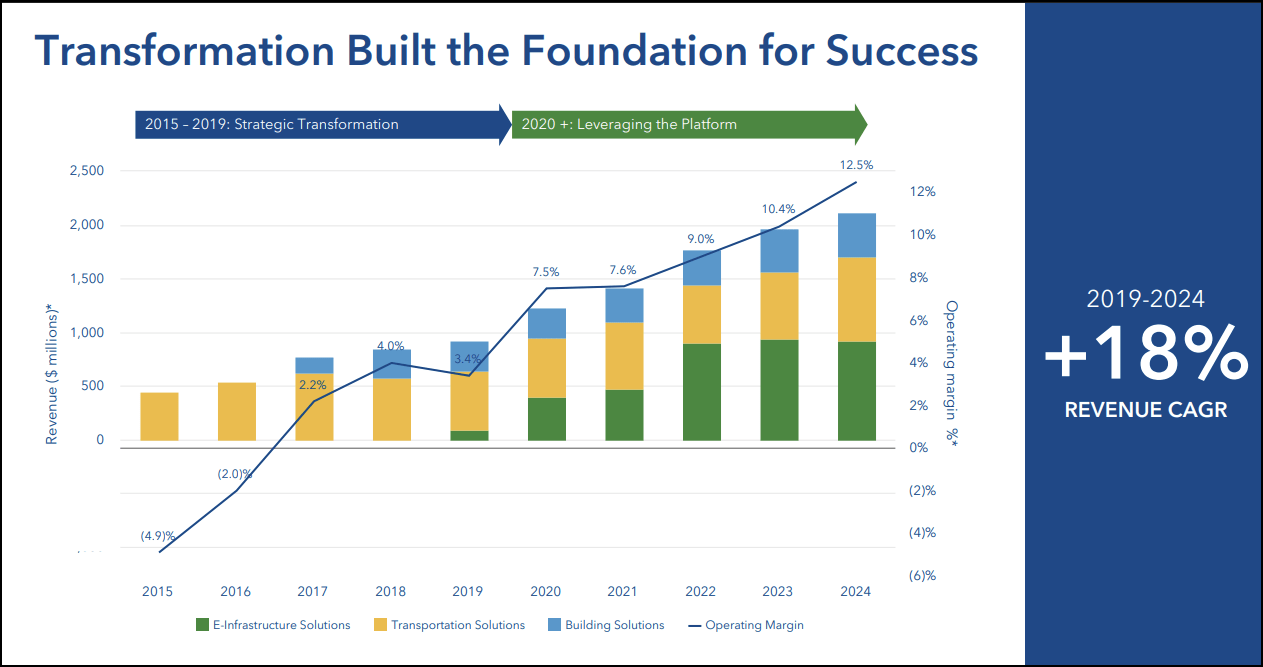

As the #2 Quant-rated Construction and Engineering stock, Sterling Infrastructure Inc. (STRL) continues to shine as a top-performing Alpha Pick. STRL was first added to the portfolio on August 1, 2023, and has since returned an incredible 320%, earning recognition as a member of our Winners Circle, which includes stocks that have returned more than 100%. Subscribers might be curious about the rationale behind selecting a stock that's already outperformed the S&P 500 by more than 40% YTD. Alpha Picks employs a systematic, data-driven methodology that permits 'Strong Buy'-rated stocks to qualify for reselection after a 12-month period.

The portfolio has an impressive track record regarding stocks that have been re-selected, with limited downside. Modine Manufacturing Company (MOD) delivered an incredible 348% from when it was initially chosen in December 2022 and more than 50% since it was re-picked in January 2024 until it was closed in February 2025. Celestica, Inc. (CLS) has delivered triple-digit returns in both of its Alpha Pick selections, gaining 632% since October 2023 and 146% since its November 2024 re-selection.

Sterling has emerged as a dominant force in the infrastructure solutions sector, known for its execution and operational excellence, consistently beating earnings expectations for 17 consecutive quarters.

Specializing in complex infrastructure development services nationwide, STRL operates through three business segments:

E-Infrastructure Solutions: providing comprehensive site development services for data centers, manufacturing facilities, e-commerce distribution centers, warehousing, and power generation projects.

Transportation Solutions: servicing highway construction, bridge rehabilitation, airport infrastructure, rail systems, and storm drainage projects.

Building Solutions: providing residential and commercial concrete foundation services across high-growth metropolitan markets.

Sterling’s strategic focus centers on large-scale projects in the rapidly expanding data center market within its E-Infrastructure segment. Data center work now represents over 65% of the segment's backlog and has grown approximately 60% in revenue year-over-year.

Our Buy Thesis

Sterling is strategically positioned at the intersection of multiple, powerful tailwinds, including AI-driven data center expansion, domestic manufacturing reshoring, and continued infrastructure investment. The company’s E-Infrastructure segment serves as its primary growth catalyst, capitalizing on unprecedented demand for data center infrastructure.

Sterling’s specialized expertise, combined with its reputation for delivering projects on or ahead of schedule, makes it a critical partner for tech companies racing to build AI computing capacity. Despite the emphasis on data centers, the company maintains diversified exposure to multiple growth sectors, making it well-positioned to weather challenging macroeconomic conditions.

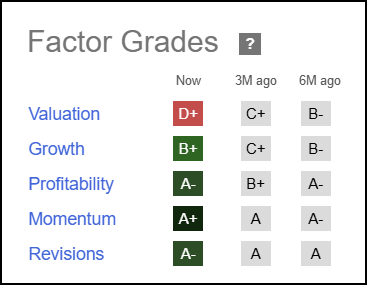

Seeking Alpha Factor Grades rates investment characteristics on a sector-relative basis. The company exhibits excellent fundamentals, including rock-solid profitability and strong growth. STRL also displays exceptional timeliness indicators, including powerful ‘A+’ momentum and compelling earnings revisions.

STRL Stock Factor Grades

STRL Stock Growth and Profitability

Sterling Infrastructure delivered an impressive Q1 2025 performance, with revenue climbing 7% to $431 million on a pro forma basis, driven by 18% growth in E-Infrastructure Solutions and 9% growth in Transportation Solutions. The company's backlog reached $2.1 billion, representing a 17% year-over-year increase, with the E-Infrastructure backlog specifically growing 27%.

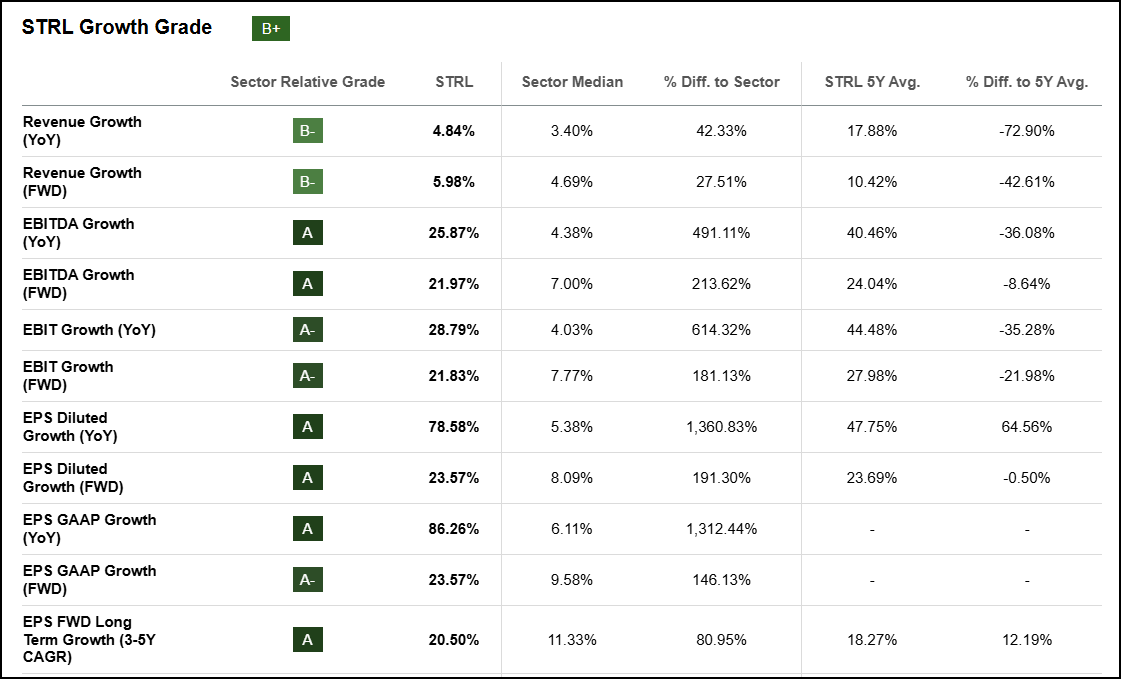

STRL's forward-looking growth prospects are as compelling as its recent performance. The company’s FWD EPS Diluted Growth stands at 24%, while its FWD EPS Long-Term Growth (3-5Y CAGR) is more than 80% above the sector median.

STRL Growth Grade

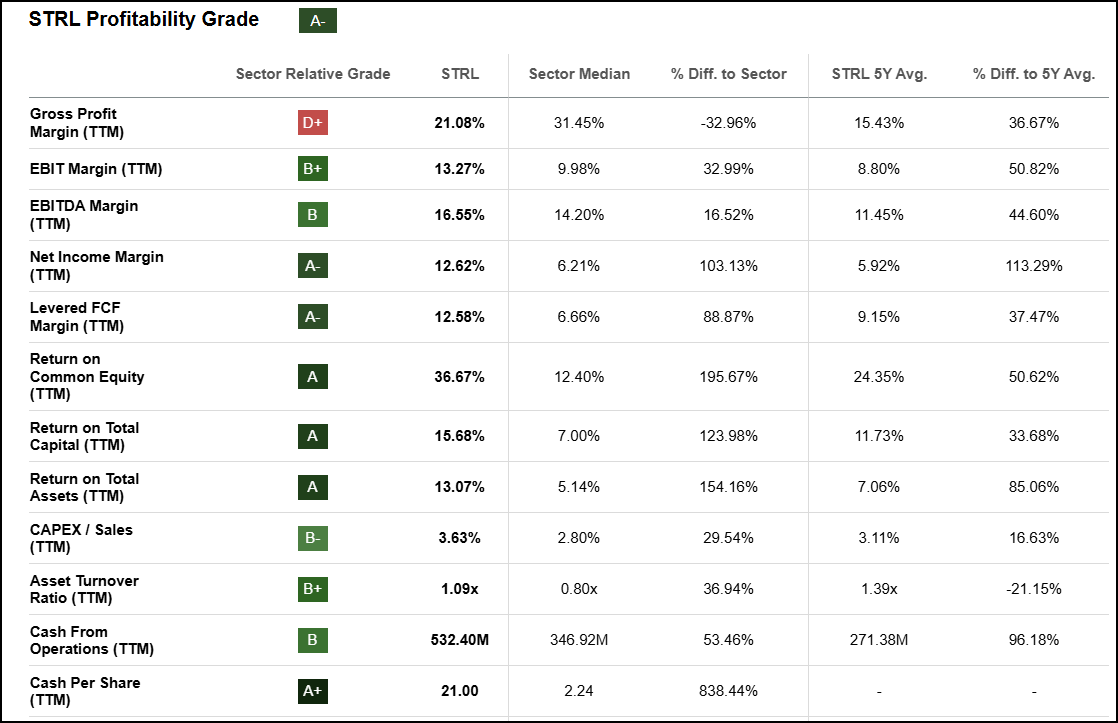

In terms of profitability, gross margins expanded 400+ basis points to 22% in Q1, while EPS climbed 29% Y/Y to $1.63. These earnings achievements are reflected in the company’s impressive profitability grade. STRL boasts an ROE of 37% and cash per share of $21.00 vs. $2.24 for the sector.

STRL Profitability Grade

Sterling's impressive combination of growth and profitability has driven unanimous positive earnings revisions, resulting in an ‘A-’ EPS revision grade.

STRL Stock Valuation

Sterling's ‘A+’ momentum over the last year has made its valuation a bit rich. However, when examining the stock on a trailing twelve-month PEG basis, it trades at a 66% discount relative to the industrials sector. The PEG ratio remains particularly important because it accounts for both the stock's current valuation relative to earnings and its expected growth rate, providing a more comprehensive measure of whether a high-growth company like Sterling is fairly valued.

Potential Risks

Tariff risks and supply chain disruptions are key risks for STRL, as these factors can increase project expenses and squeeze profit margins. Legal or regulatory gridlock around federal infrastructure spending could also slow project flow for Sterling, potentially impacting the timing and pace of new awards and backlog execution. The company is exposed to broader market downturns, though it is important to note it is well-diversified across multiple sectors, which helps mitigate some of this cyclicality. Additionally, Sterling’s backlog is heavily dependent on spending by large technology firms and AI-related data center projects, making it vulnerable if that investment pace slows.

Recent acquisitions aimed at supporting growth increase financial leverage and integration risks for STRL. However, as noted by Interim Principal Financial Officer, Ronald Ballschmiede, the company is on solid financial footing:

We ended the quarter with a very strong liquidity position consisting of $638.6 million of cash and debt of $310 million for a cash net of debt balance of $328.6 million. In addition, our $75 million revolving credit facility remains unused during the period.

Concluding Summary

Sterling Infrastructure (STRL) has emerged as a top-performing Alpha Pick, delivering an exceptional 320% since first being selected on August 1, 2023. The company's specialization in AI-driven data center development has served as its primary growth catalyst, with data center work representing over 65% of the E-Infrastructure segment's $1.2 billion backlog while maintaining diversified exposure across other critical infrastructure segments. This strategic positioning drove exceptional Q1 2025 performance, with revenue growing 7% to $431 million, powered by 18% growth in E-Infrastructure Solutions, while EPS surged 29% to $1.63 and gross margins expanded 400+ basis points to 22%. Although the stock's strong momentum has created a richer valuation, STRL continues to trade at a 66% discount in terms of its TTM PEG ratio, suggesting the market has yet to fully recognize the company's exceptional fundamentals.

For Alpha Picks investors with a fixed amount of capital who are looking for a more active approach, consider the PRO Quant Portfolio (PQP). PQP delivers a disciplined, data-driven, systematic model portfolio. Like Alpha Picks, PQP is powered by Seeking Alpha's proprietary Quant system. The portfolio draws from nearly 5,000 U.S.-listed stocks and ADRs worldwide, selecting top opportunities based on rigorous multi-factor selection. PQP holds 30 equal-weighted positions, rebalanced weekly to reflect updated ratings and market conditions. Subscribers receive weekly alerts on all trades and detailed analysis from the Quant Team, making it easy to follow or use as an idea generator. Register for next week’s PRO Quant Portfolio Update, where we’ll cover recent portfolio activity, market trends, and answer questions live.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha